TriplePoint Venture Growth BDC Corp. (TPVG): Price and Financial Metrics

TPVG Price/Volume Stats

| Current price | $10.89 | 52-week high | $12.87 |

| Prev. close | $10.94 | 52-week low | $9.13 |

| Day low | $10.84 | Volume | 143,500 |

| Day high | $10.97 | Avg. volume | 211,985 |

| 50-day MA | $10.93 | Dividend yield | 14.48% |

| 200-day MA | $10.93 | Market Cap | 392.98M |

TPVG Stock Price Chart Interactive Chart >

TPVG POWR Grades

- TPVG scores best on the Growth dimension, with a Growth rank ahead of 80.4% of US stocks.

- The strongest trend for TPVG is in Growth, which has been heading down over the past 26 weeks.

- TPVG ranks lowest in Quality; there it ranks in the 16th percentile.

TPVG Stock Summary

- Of note is the ratio of TRIPLEPOINT VENTURE GROWTH BDC CORP's sales and general administrative expense to its total operating expenses; 87.34% of US stocks have a lower such ratio.

- The ratio of debt to operating expenses for TRIPLEPOINT VENTURE GROWTH BDC CORP is higher than it is for about 98.83% of US stocks.

- Revenue growth over the past 12 months for TRIPLEPOINT VENTURE GROWTH BDC CORP comes in at 26.39%, a number that bests 82.57% of the US stocks we're tracking.

- If you're looking for stocks that are quantitatively similar to TRIPLEPOINT VENTURE GROWTH BDC CORP, a group of peers worth examining would be GLAD, OFS, FDUS, SACH, and SAR.

- Visit TPVG's SEC page to see the company's official filings. To visit the company's web site, go to www.tpvg.com.

TPVG Valuation Summary

- In comparison to the median Financial Services stock, TPVG's EV/EBIT ratio is 413.81% higher, now standing at 61.4.

- Over the past 118 months, TPVG's price/sales ratio has gone NA NA.

Below are key valuation metrics over time for TPVG.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| TPVG | 2023-12-22 | 2.7 | 1 | -16.7 | 61.4 |

| TPVG | 2023-12-21 | 2.7 | 1 | -16.8 | 61.4 |

| TPVG | 2023-12-20 | 2.7 | 1 | -16.7 | 61.2 |

| TPVG | 2023-12-19 | 2.7 | 1 | -16.8 | 61.4 |

| TPVG | 2023-12-18 | 2.7 | 1 | -16.5 | 61.1 |

| TPVG | 2023-12-15 | 2.7 | 1 | -16.6 | 61.2 |

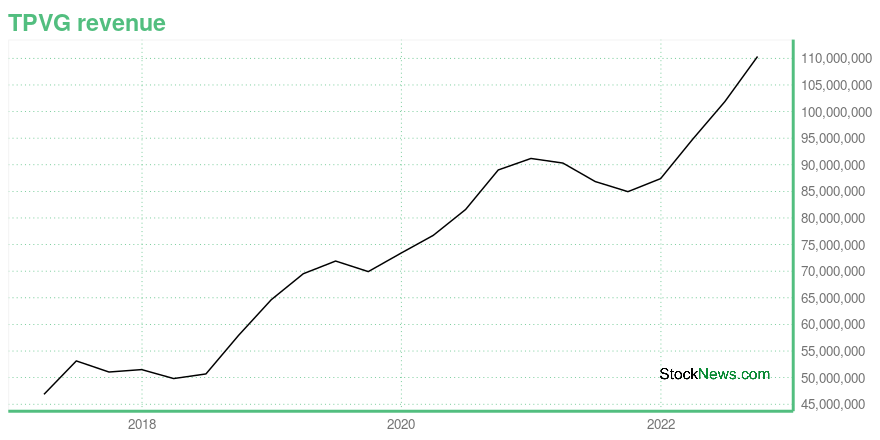

TPVG Growth Metrics

- Its 3 year net income to common stockholders growth rate is now at 77.39%.

- Its 2 year price growth rate is now at 110.58%.

- Its 3 year price growth rate is now at 9.85%.

The table below shows TPVG's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 110.345 | -175.489 | 5.577 |

| 2022-06-30 | 101.874 | -176.096 | 44.005 |

| 2022-03-31 | 94.768 | -95.83 | 70.404 |

| 2021-12-31 | 87.392 | -144.679 | 76.558 |

| 2021-09-30 | 84.946 | -50.16 | 67.464 |

| 2021-06-30 | 86.844 | 93.907 | 43.048 |

TPVG's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- TPVG has a Quality Grade of C, ranking ahead of 52.29% of graded US stocks.

- TPVG's asset turnover comes in at 0.116 -- ranking 172nd of 444 Trading stocks.

- ACR, CONE, and WSR are the stocks whose asset turnover ratios are most correlated with TPVG.

The table below shows TPVG's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.116 | 0.739 | 0.085 |

| 2021-06-30 | 0.124 | 0.736 | 0.063 |

| 2021-03-31 | 0.128 | 0.740 | 0.072 |

| 2020-12-31 | 0.127 | 0.768 | 0.052 |

| 2020-09-30 | 0.124 | 0.785 | 0.052 |

| 2020-06-30 | 0.117 | 0.795 | 0.029 |

TriplePoint Venture Growth BDC Corp. (TPVG) Company Bio

TriplePoint Venture Growth BDC Corp is a business development company specializing investments in growth stage. It also provides debt financing to venture growth space companies which includes growth capital loans, equipment financings, revolving loans, and direct equity investments. The fund seeks to invest in e-commerce, entertainment, technology and life sciences sector. The company is based in Menlo Park, California.

Latest TPVG News From Around the Web

Below are the latest news stories about TRIPLEPOINT VENTURE GROWTH BDC CORP that investors may wish to consider to help them evaluate TPVG as an investment opportunity.

TriplePoint Venture Growth BDC Corp. (NYSE:TPVG) Q3 2023 Earnings Call TranscriptTriplePoint Venture Growth BDC Corp. (NYSE:TPVG) Q3 2023 Earnings Call Transcript November 1, 2023 Operator: Good afternoon, ladies and gentlemen. Welcome to the TriplePoint Venture Growth BDC Corp. Third Quarter 2023 Earnings Conference Call. [Operator Instructions]. This conference is being recorded, and a replay of the call will be available in an audio webcast on […] |

TriplePoint Venture Growth BDC Corp. Announces Third Quarter 2023 Financial ResultsMENLO PARK, Calif., November 01, 2023--TriplePoint Venture Growth BDC Corp. (NYSE: TPVG) (the "Company," "TPVG," "we," "us," or "our"), the leading financing provider to venture growth stage companies backed by a select group of venture capital firms in technology and other high growth industries, today announced its financial results for the third quarter ended September 30, 2023 and the declaration by its Board of Directors of its fourth quarter 2023 distribution of $0.40 per share. |

3 Dividend Stocks to Avoid at All Costs: October 2023The economy is weakening, and these three dividend stocks to sell could take a hit as the damage spreads. |

TriplePoint Venture Growth BDC Corp. to Announce 2023 Third Quarter Financial Results on Wednesday, November 1, 2023MENLO PARK, Calif., October 18, 2023--TriplePoint Venture Growth BDC Corp. (NYSE: TPVG) (the "Company"), the leading financing provider to venture growth stage companies backed by a select group of venture capital firms in technology and other high growth industries, today announced it will release its financial results for its third quarter ended September 30, 2023 after market-close on Wednesday, November 1, 2023. James P. Labe, chief executive officer and chairman of the board, Sajal K. Sriva |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on ThursdayWe're starting off the day with a breakdown of all the biggest pre-market stock movers worth reading about on Thursday morning! |

TPVG Price Returns

| 1-mo | -3.29% |

| 3-mo | 11.42% |

| 6-mo | 4.37% |

| 1-year | 9.02% |

| 3-year | 7.97% |

| 5-year | 54.26% |

| YTD | 0.28% |

| 2023 | 20.29% |

| 2022 | -34.66% |

| 2021 | 50.54% |

| 2020 | 5.70% |

| 2019 | 44.22% |

TPVG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching TPVG

Want to see what other sources are saying about TriplePoint Venture Growth BDC Corp's financials and stock price? Try the links below:TriplePoint Venture Growth BDC Corp (TPVG) Stock Price | Nasdaq

TriplePoint Venture Growth BDC Corp (TPVG) Stock Quote, History and News - Yahoo Finance

TriplePoint Venture Growth BDC Corp (TPVG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...