Compass Diversified Holdings Shares of Beneficial Interest (CODI): Price and Financial Metrics

CODI Price/Volume Stats

| Current price | $22.01 | 52-week high | $23.27 |

| Prev. close | $21.59 | 52-week low | $16.88 |

| Day low | $21.45 | Volume | 535,900 |

| Day high | $22.21 | Avg. volume | 212,189 |

| 50-day MA | $21.76 | Dividend yield | 4.6% |

| 200-day MA | $20.52 | Market Cap | 1.58B |

CODI Stock Price Chart Interactive Chart >

CODI POWR Grades

- Growth is the dimension where CODI ranks best; there it ranks ahead of 88.43% of US stocks.

- The strongest trend for CODI is in Value, which has been heading up over the past 26 weeks.

- CODI ranks lowest in Quality; there it ranks in the 10th percentile.

CODI Stock Summary

- Price to trailing twelve month operating cash flow for CODI is currently 23.21, higher than 80.23% of US stocks with positive operating cash flow.

- CODI's price/sales ratio is 0.71; that's higher than the P/S ratio of merely 23.42% of US stocks.

- The volatility of COMPASS DIVERSIFIED HOLDINGS's share price is greater than that of merely 19.61% US stocks with at least 200 days of trading history.

- Stocks with similar financial metrics, market capitalization, and price volatility to COMPASS DIVERSIFIED HOLDINGS are GHC, AAME, PTSI, WERN, and AWX.

- Visit CODI's SEC page to see the company's official filings. To visit the company's web site, go to www.compassequity.com.

CODI Valuation Summary

- CODI's EV/EBIT ratio is 14.6; this is 16.09% lower than that of the median Industrials stock.

- CODI's price/earnings ratio has moved up 298016.6 over the prior 214 months.

Below are key valuation metrics over time for CODI.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| CODI | 2023-12-29 | 0.7 | 1.4 | 16.6 | 14.6 |

| CODI | 2023-12-28 | 0.7 | 1.4 | 16.8 | 14.6 |

| CODI | 2023-12-27 | 0.7 | 1.4 | 16.9 | 14.7 |

| CODI | 2023-12-26 | 0.7 | 1.4 | 16.8 | 14.6 |

| CODI | 2023-12-22 | 0.7 | 1.4 | 16.5 | 14.5 |

| CODI | 2023-12-21 | 0.7 | 1.4 | 16.3 | 14.4 |

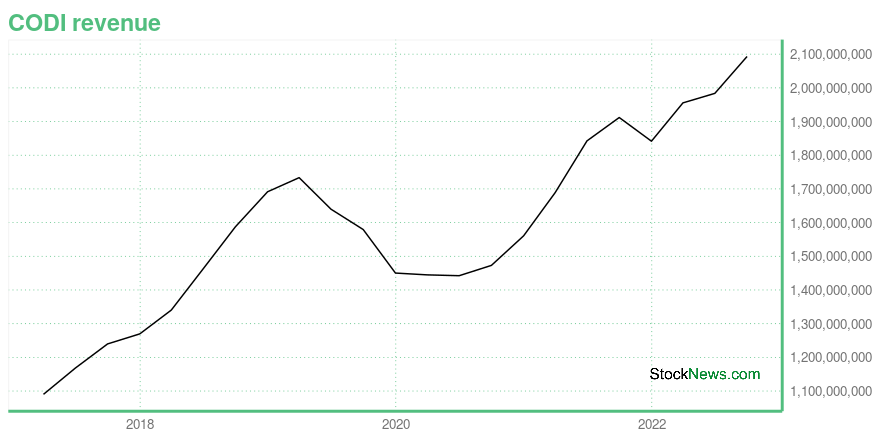

CODI Growth Metrics

- Its 2 year net cashflow from operations growth rate is now at -49.69%.

- Its year over year price growth rate is now at -16.32%.

- Its year over year revenue growth rate is now at 15.79%.

The table below shows CODI's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 2,093.119 | -53.02 | 70.443 |

| 2022-06-30 | 1,983.67 | -10.72 | 160.317 |

| 2022-03-31 | 1,955.511 | 64.131 | 119.32 |

| 2021-12-31 | 1,841.668 | 134.051 | 114.552 |

| 2021-09-30 | 1,911.97 | 182.901 | 100.83 |

| 2021-06-30 | 1,842.715 | 169.729 | 31.916 |

CODI's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- CODI has a Quality Grade of D, ranking ahead of 21.19% of graded US stocks.

- CODI's asset turnover comes in at 0.686 -- ranking 38th of 50 Consumer Goods stocks.

- PG, SCL, and IRBT are the stocks whose asset turnover ratios are most correlated with CODI.

The table below shows CODI's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.686 | 0.383 | 0.069 |

| 2021-03-31 | 0.661 | 0.373 | 0.073 |

| 2020-12-31 | 0.695 | 0.361 | 0.068 |

| 2020-09-30 | 0.712 | 0.361 | 0.065 |

| 2020-06-30 | 0.702 | 0.357 | 0.025 |

| 2020-03-31 | 0.683 | 0.359 | 0.211 |

Compass Diversified Holdings Shares of Beneficial Interest (CODI) Company Bio

Compass Diversified Holdings is a private equity firm specializing in acquisitions, buyouts, and middle market investments. The company was founded in 2005 and is based in Westport, Connecticut.

Latest CODI News From Around the Web

Below are the latest news stories about COMPASS DIVERSIFIED HOLDINGS that investors may wish to consider to help them evaluate CODI as an investment opportunity.

Compass Diversified Receives $75.2 Million Equity InvestmentCapital Infusion Further Boosts Liquidity and Positions CODI for Accelerated GrowthWESTPORT, Conn., Dec. 21, 2023 (GLOBE NEWSWIRE) -- Compass Diversified (NYSE: CODI) (“CODI” or the “Company”), an owner of leading middle market businesses, has completed a private placement of approximately 3.6 million of its common shares to a mutual fund managed by Allspring Global Investments, LLC (“Allspring”) for $21.18 per share, or an aggregate sale price of approximately $75.2 million. The use of proceeds |

Compass Diversified to Host Investor Day on January 17, 2024 in Newport Beach, CaliforniaWESTPORT, Conn., Dec. 20, 2023 (GLOBE NEWSWIRE) -- Compass Diversified (NYSE: CODI) (“CODI” or the “Company”), an owner of leading middle market businesses, today announced that it will host an investor day on Wednesday, January 17, 2024, from 8:00am to 2:15pm PT in Newport Beach, California. The hybrid event will include presentations by the CODI management team and will showcase the Company’s Lugano Diamonds subsidiary, followed by Q&A sessions. In-person attendees will also receive a tour of |

Compass Diversified Announces Appointment of Anne Cavassa as CEO of PrimaLoftMike Joyce to Assume Role of Vice Chairman of the PrimaLoft BoardWESTPORT, Conn., Dec. 19, 2023 (GLOBE NEWSWIRE) -- Compass Diversified (NYSE: CODI) ("CODI" or the "Company”), an owner of leading middle market businesses, proudly announces the appointment of Anne Cavassa as the Chief Executive Officer of its subsidiary, PrimaLoft Inc., effective January 1st, 2024. This move follows Cavassa’s recent appointment as President of the company. The changes come as former President and CEO, Mike Joyce, |

Little Excitement Around Compass Diversified's (NYSE:CODI) RevenuesYou may think that with a price-to-sales (or "P/S") ratio of 0.7x Compass Diversified ( NYSE:CODI ) is a stock worth... |

Following a 1.3% decline over last year, recent gains may please Compass Diversified (NYSE:CODI) institutional ownersKey Insights Significantly high institutional ownership implies Compass Diversified's stock price is sensitive to their... |

CODI Price Returns

| 1-mo | 0.30% |

| 3-mo | 20.04% |

| 6-mo | 2.40% |

| 1-year | 4.66% |

| 3-year | 19.71% |

| 5-year | 97.62% |

| YTD | -0.81% |

| 2023 | 29.38% |

| 2022 | -37.72% |

| 2021 | 71.52% |

| 2020 | -15.53% |

| 2019 | 116.86% |

CODI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CODI

Want to do more research on Compass Diversified Holdings's stock and its price? Try the links below:Compass Diversified Holdings (CODI) Stock Price | Nasdaq

Compass Diversified Holdings (CODI) Stock Quote, History and News - Yahoo Finance

Compass Diversified Holdings (CODI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...