Main Street Capital Corporation (MAIN): Price and Financial Metrics

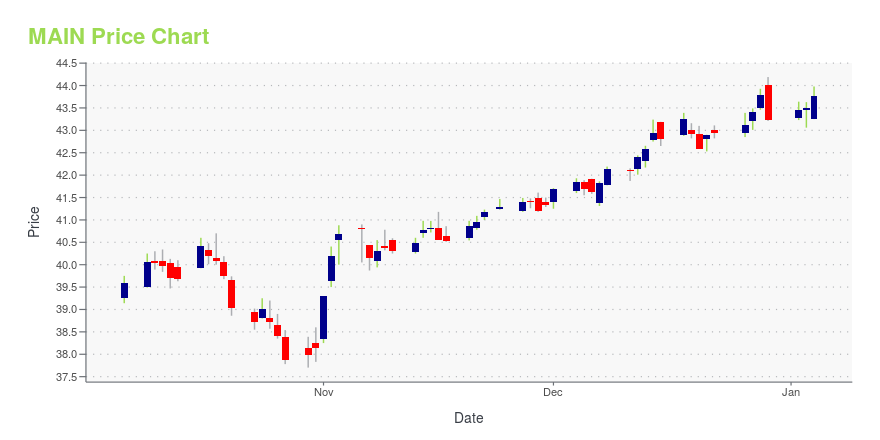

MAIN Price/Volume Stats

| Current price | $44.57 | 52-week high | $46.04 |

| Prev. close | $45.02 | 52-week low | $36.48 |

| Day low | $44.33 | Volume | 307,700 |

| Day high | $44.97 | Avg. volume | 362,037 |

| 50-day MA | $43.57 | Dividend yield | 6.4% |

| 200-day MA | $41.06 | Market Cap | 3.73B |

MAIN Stock Price Chart Interactive Chart >

MAIN POWR Grades

- Quality is the dimension where MAIN ranks best; there it ranks ahead of 79.33% of US stocks.

- MAIN's strongest trending metric is Quality; it's been moving up over the last 26 weeks.

- MAIN's current lowest rank is in the Sentiment metric (where it is better than 24.02% of US stocks).

MAIN Stock Summary

- Of note is the ratio of MAIN STREET CAPITAL CORP's sales and general administrative expense to its total operating expenses; 98.78% of US stocks have a lower such ratio.

- For MAIN, its debt to operating expenses ratio is greater than that reported by 97.72% of US equities we're observing.

- The volatility of MAIN STREET CAPITAL CORP's share price is greater than that of merely 0.5% US stocks with at least 200 days of trading history.

- Stocks that are quantitatively similar to MAIN, based on their financial statements, market capitalization, and price volatility, are BNL, MAA, TRN, LXU, and HASI.

- Visit MAIN's SEC page to see the company's official filings. To visit the company's web site, go to www.mainstcapital.com.

MAIN Valuation Summary

- MAIN's price/sales ratio is 7.4; this is 516.67% higher than that of the median Financial Services stock.

- Over the past 196 months, MAIN's price/sales ratio has gone down 4.2.

Below are key valuation metrics over time for MAIN.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| MAIN | 2023-12-22 | 7.4 | 1.5 | 9.1 | 10.4 |

| MAIN | 2023-12-21 | 7.4 | 1.5 | 9.1 | 10.4 |

| MAIN | 2023-12-20 | 7.4 | 1.5 | 9.0 | 10.3 |

| MAIN | 2023-12-19 | 7.4 | 1.5 | 9.1 | 10.4 |

| MAIN | 2023-12-18 | 7.5 | 1.5 | 9.2 | 10.4 |

| MAIN | 2023-12-15 | 7.4 | 1.5 | 9.1 | 10.3 |

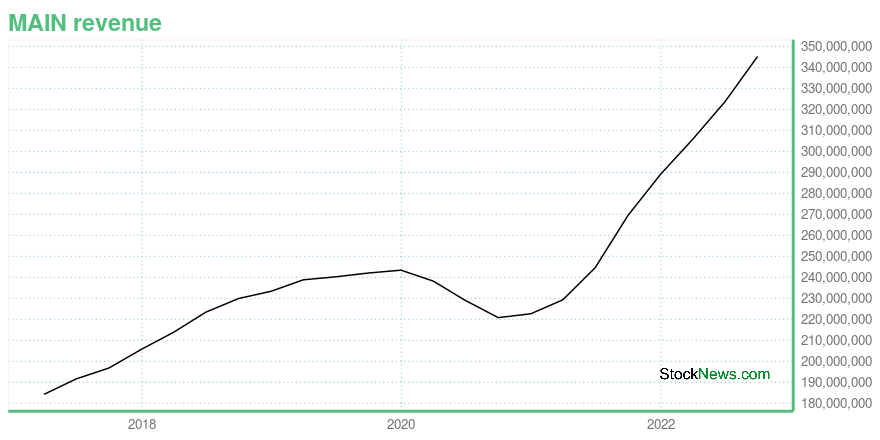

MAIN Growth Metrics

- The 2 year net cashflow from operations growth rate now stands at -1136.84%.

- Its 2 year price growth rate is now at 50.65%.

- The 5 year revenue growth rate now stands at 29.28%.

The table below shows MAIN's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 345.148 | -613.989 | 229.639 |

| 2022-06-30 | 323.54 | -446.614 | 258.257 |

| 2022-03-31 | 305.634 | -540.099 | 338.618 |

| 2021-12-31 | 289.047 | -515.373 | 330.762 |

| 2021-09-30 | 269.385 | -184.519 | 315.669 |

| 2021-06-30 | 244.56 | -201.983 | 309.908 |

MAIN's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- MAIN has a Quality Grade of B, ranking ahead of 76.58% of graded US stocks.

- MAIN's asset turnover comes in at 0.086 -- ranking 246th of 444 Trading stocks.

- SVC, GBCS, and OUT are the stocks whose asset turnover ratios are most correlated with MAIN.

The table below shows MAIN's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.086 | 1 | 0.092 |

| 2021-03-31 | 0.084 | 1 | 0.078 |

| 2020-12-31 | 0.085 | 1 | 0.018 |

| 2020-09-30 | 0.085 | 1 | 0.000 |

| 2020-06-30 | 0.088 | 1 | -0.013 |

| 2020-03-31 | 0.091 | 1 | -0.012 |

Main Street Capital Corporation (MAIN) Company Bio

Main Street Capital is a principal investment firm that provides long-term debt and equity capital to lower middle market companies and debt capital to middle market companies. Main Street's portfolio investments are typically made to support management buyouts, recapitalizations, growth financings, refinancings and acquisitions of companies that operate in diverse industry sectors. The company was founded in 1997 and is based at Houston, Texas.

Latest MAIN News From Around the Web

Below are the latest news stories about MAIN STREET CAPITAL CORP that investors may wish to consider to help them evaluate MAIN as an investment opportunity.

Main Street Announces New Portfolio InvestmentMain Street Capital Corporation (NYSE: MAIN) ("Main Street") is pleased to announce that it recently completed a new portfolio investment totaling $43.2 million to facilitate the recapitalization of Pinnacle Plastics, Inc. and Integrity Plastics, Inc. (together, "Pinnacle" or the "Company"), a manufacturer and distributor of commercial can liners, polyethylene bags, produce bags, and other adjacent products for use predominantly in the quick-service restaurant, convenience store, and janitorial |

7 Growth Stocks That Also Pay Monthly Dividends: December 2023While it’s obvious there are great reasons to buy and hold stocks, it’s also easy to overlook a regular income gained by owning monthly dividend-paying growth stocks. |

3 Ultra High-Yield Dividend Stocks That Can Pay Your Rent Every MonthBuying ultra high-yield dividend stocks that offer safe and monthly income streams can help investors meet their monthly bills. |

3 Monthly Dividend Stocks for Steady Income in 2024Watch your investments grow by enjoying monthly returns through these three monthly dividend stocks in the new year. |

Main Street Capital Corp's Dividend AnalysisMain Street Capital Corp (NYSE:MAIN) recently announced a dividend of $0.24 per share, payable on 2024-01-12, with the ex-dividend date set for 2024-01-04. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Main Street Capital Corp's dividend performance and assess its sustainability. |

MAIN Price Returns

| 1-mo | 2.35% |

| 3-mo | 13.16% |

| 6-mo | 14.87% |

| 1-year | 24.47% |

| 3-year | 65.33% |

| 5-year | 74.20% |

| YTD | 4.23% |

| 2023 | 28.22% |

| 2022 | -11.79% |

| 2021 | 48.31% |

| 2020 | -19.54% |

| 2019 | 36.23% |

MAIN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MAIN

Want to see what other sources are saying about Main Street Capital CORP's financials and stock price? Try the links below:Main Street Capital CORP (MAIN) Stock Price | Nasdaq

Main Street Capital CORP (MAIN) Stock Quote, History and News - Yahoo Finance

Main Street Capital CORP (MAIN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...