Horizon Technology Finance Corporation (HRZN): Price and Financial Metrics

HRZN Price/Volume Stats

| Current price | $13.09 | 52-week high | $13.73 |

| Prev. close | $13.09 | 52-week low | $10.14 |

| Day low | $13.04 | Volume | 86,200 |

| Day high | $13.17 | Avg. volume | 213,926 |

| 50-day MA | $13.07 | Dividend yield | 9.95% |

| 200-day MA | $12.35 | Market Cap | 436.30M |

HRZN Stock Price Chart Interactive Chart >

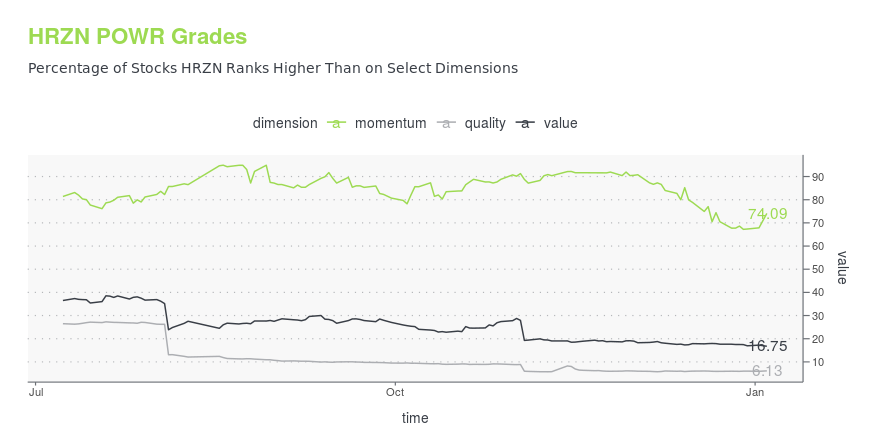

HRZN POWR Grades

- HRZN scores best on the Momentum dimension, with a Momentum rank ahead of 74.09% of US stocks.

- The strongest trend for HRZN is in Value, which has been heading down over the past 26 weeks.

- HRZN ranks lowest in Quality; there it ranks in the 6th percentile.

HRZN Stock Summary

- With a one year PEG ratio of 636.48, HORIZON TECHNOLOGY FINANCE CORP is expected to have a higher PEG ratio (a measure of how expensive a stock is relative to its expected earnings growth) than 94.88% of US stocks.

- The ratio of debt to operating expenses for HORIZON TECHNOLOGY FINANCE CORP is higher than it is for about 98.91% of US stocks.

- In terms of volatility of its share price, HRZN is more volatile than merely 4.27% of stocks we're observing.

- If you're looking for stocks that are quantitatively similar to HORIZON TECHNOLOGY FINANCE CORP, a group of peers worth examining would be SAR, SACH, TPVG, GLAD, and DKL.

- HRZN's SEC filings can be seen here. And to visit HORIZON TECHNOLOGY FINANCE CORP's official web site, go to www.horizontechfinance.com.

HRZN Valuation Summary

- In comparison to the median Financial Services stock, HRZN's EV/EBIT ratio is 170.29% higher, now standing at 32.3.

- Over the past 158 months, HRZN's EV/EBIT ratio has gone up 20.6.

Below are key valuation metrics over time for HRZN.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| HRZN | 2023-12-22 | 4.1 | 1.3 | -176.2 | 32.3 |

| HRZN | 2023-12-21 | 4.0 | 1.3 | -174.8 | 32.2 |

| HRZN | 2023-12-20 | 4.0 | 1.3 | -173.9 | 32.1 |

| HRZN | 2023-12-19 | 4.0 | 1.3 | -174.0 | 32.1 |

| HRZN | 2023-12-18 | 4.0 | 1.3 | -173.4 | 32.0 |

| HRZN | 2023-12-15 | 4.0 | 1.3 | -174.2 | 32.1 |

HRZN Growth Metrics

- Its 4 year cash and equivalents growth rate is now at -12.96%.

- Its 2 year price growth rate is now at 37.18%.

- The 3 year net income to common stockholders growth rate now stands at 88.24%.

The table below shows HRZN's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 72.991 | -163.171 | 19.398 |

| 2022-06-30 | 66.104 | -148.118 | 26.172 |

| 2022-03-31 | 61.005 | -110.424 | 25.285 |

| 2021-12-31 | 60.015 | -75.992 | 27.782 |

| 2021-09-30 | 53.137 | -110.889 | 27.913 |

| 2021-06-30 | 49.101 | -34.191 | 11.896 |

HRZN's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- HRZN has a Quality Grade of D, ranking ahead of 22.49% of graded US stocks.

- HRZN's asset turnover comes in at 0.116 -- ranking 172nd of 444 Trading stocks.

- APTS, FSP, and BDN are the stocks whose asset turnover ratios are most correlated with HRZN.

The table below shows HRZN's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.116 | 0.751 | 0.061 |

| 2021-06-30 | 0.115 | 0.750 | 0.039 |

| 2021-03-31 | 0.119 | 0.750 | 0.041 |

| 2020-12-31 | 0.117 | 0.747 | 0.030 |

| 2020-09-30 | 0.130 | 0.751 | 0.039 |

| 2020-06-30 | 0.132 | 0.751 | 0.055 |

HRZN Price Target

For more insight on analysts targets of HRZN, see our HRZN price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $14.85 | Average Broker Recommendation | 2.1 (Hold) |

Horizon Technology Finance Corporation (HRZN) Company Bio

Horizon Technology Finance Corporation operates as an externally managed, closed-end, non-diversified management investment company. The Company lends and invests in development stage companies within the technology, life science, healthcare information and services, and cleantech industries. The company is based in Farmington, Connecticut.

Latest HRZN News From Around the Web

Below are the latest news stories about HORIZON TECHNOLOGY FINANCE CORP that investors may wish to consider to help them evaluate HRZN as an investment opportunity.

3 Top-Ranked Small-Caps with Big GrowthWhile small-cap stocks can see volatile price swings, their growth potential is hard to ignore. |

Want $200 in Monthly Dividend Income in 2024? Invest $27,000 in This Ultra-High-Yield TrioThese supercharged income stocks, which sport an average yield of 8.9%, can fatten your pocketbook every month in the new year. |

3 of the Best Monthly Dividend Stocks for InvestorsDid you know there is a group of stocks that make payments once a month rather than quarterly or semi-annually? |

Want $300 in Super-Safe Monthly Dividend Income? Invest $37,800 Into the Following 3 Ultra-High-Yield StocksThese supercharged dividend stocks, which sport an average yield of 9.52%, can really fatten income investors' pocketbooks. |

Growth Stocks With Monthly Dividends: 7 Top PicksBesides providing investors juicy dividend payouts, these seven growth stocks with monthly dividends also have strong appreciation potential. |

HRZN Price Returns

| 1-mo | -0.73% |

| 3-mo | 11.31% |

| 6-mo | 11.85% |

| 1-year | 19.67% |

| 3-year | 21.70% |

| 5-year | 73.59% |

| YTD | 0.25% |

| 2023 | 26.99% |

| 2022 | -19.72% |

| 2021 | 29.74% |

| 2020 | 14.08% |

| 2019 | 25.81% |

HRZN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching HRZN

Want to see what other sources are saying about Horizon Technology Finance Corp's financials and stock price? Try the links below:Horizon Technology Finance Corp (HRZN) Stock Price | Nasdaq

Horizon Technology Finance Corp (HRZN) Stock Quote, History and News - Yahoo Finance

Horizon Technology Finance Corp (HRZN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...