Limoneira Co (LMNR): Price and Financial Metrics

LMNR Price/Volume Stats

| Current price | $17.77 | 52-week high | $21.62 |

| Prev. close | $17.88 | 52-week low | $13.88 |

| Day low | $17.69 | Volume | 24,000 |

| Day high | $18.02 | Avg. volume | 42,841 |

| 50-day MA | $18.72 | Dividend yield | 1.69% |

| 200-day MA | $16.23 | Market Cap | 319.75M |

LMNR Stock Price Chart Interactive Chart >

LMNR POWR Grades

- Stability is the dimension where LMNR ranks best; there it ranks ahead of 39.98% of US stocks.

- The strongest trend for LMNR is in Value, which has been heading down over the past 26 weeks.

- LMNR ranks lowest in Momentum; there it ranks in the 0th percentile.

LMNR Stock Summary

- Of note is the ratio of LIMONEIRA CO's sales and general administrative expense to its total operating expenses; only 0.02% of US stocks have a lower such ratio.

- The ratio of debt to operating expenses for LIMONEIRA CO is higher than it is for about just 0.1% of US stocks.

- Over the past twelve months, LMNR has reported earnings growth of 391.35%, putting it ahead of 96.95% of US stocks in our set.

- Stocks that are quantitatively similar to LMNR, based on their financial statements, market capitalization, and price volatility, are PBF, CEPU, GDC, SBSW, and EBR.

- LMNR's SEC filings can be seen here. And to visit LIMONEIRA CO's official web site, go to www.limoneira.com.

LMNR Valuation Summary

- In comparison to the median Consumer Defensive stock, LMNR's price/sales ratio is 121.05% higher, now standing at 2.1.

- Over the past 165 months, LMNR's EV/EBIT ratio has gone up 90.4.

Below are key valuation metrics over time for LMNR.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| LMNR | 2023-12-22 | 2.1 | 2.1 | 41.5 | 28.7 |

| LMNR | 2023-12-21 | 1.9 | 1.9 | 38.8 | 27.1 |

| LMNR | 2023-12-20 | 1.9 | 1.8 | 35.1 | 22.3 |

| LMNR | 2023-12-19 | 1.9 | 1.9 | 35.2 | 22.4 |

| LMNR | 2023-12-18 | 2.0 | 1.9 | 36.3 | 23.0 |

| LMNR | 2023-12-15 | 1.9 | 1.9 | 35.5 | 22.5 |

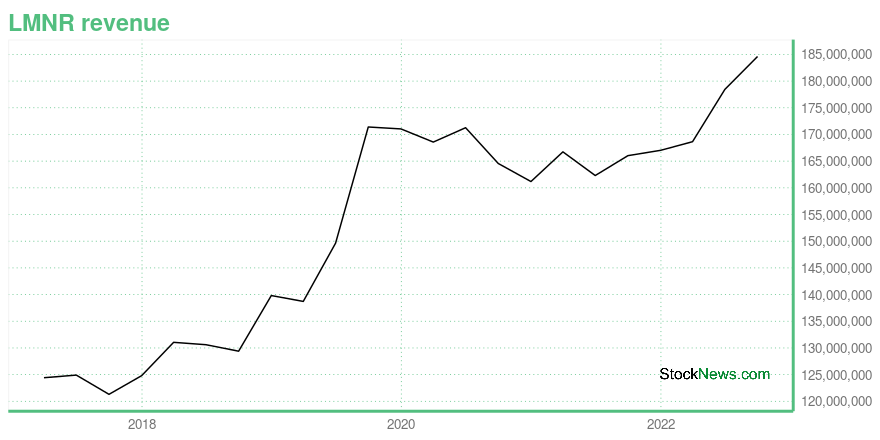

LMNR Growth Metrics

- The 2 year cash and equivalents growth rate now stands at -24.05%.

- Its 5 year revenue growth rate is now at 35.48%.

- Its 5 year net income to common stockholders growth rate is now at -236.94%.

The table below shows LMNR's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 184.605 | 14.83 | -0.737 |

| 2022-06-30 | 178.442 | 3.722 | -2.952 |

| 2022-03-31 | 168.644 | 3.802 | -6.624 |

| 2021-12-31 | 167.026 | 3.233 | -6.252 |

| 2021-09-30 | 166.027 | 9.605 | -3.942 |

| 2021-06-30 | 162.305 | 16.879 | -6.505 |

LMNR's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- LMNR has a Quality Grade of C, ranking ahead of 49.48% of graded US stocks.

- LMNR's asset turnover comes in at 0.415 -- ranking 10th of 16 Agriculture stocks.

- SISI, SITE, and CVGW are the stocks whose asset turnover ratios are most correlated with LMNR.

The table below shows LMNR's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-07-31 | 0.415 | 0.074 | -0.012 |

| 2021-04-30 | 0.423 | 0.062 | -0.017 |

| 2021-01-31 | 0.408 | 0.032 | -0.039 |

| 2020-10-31 | 0.412 | 0.017 | -0.047 |

| 2020-07-31 | 0.426 | 0.045 | -0.035 |

| 2020-04-30 | 0.415 | 0.054 | -0.041 |

LMNR Price Target

For more insight on analysts targets of LMNR, see our LMNR price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $22.00 | Average Broker Recommendation | 1.4 (Strong Buy) |

Limoneira Co (LMNR) Company Bio

Limoneira Company operates in three segments: Agribusiness, Rental Operations, and Real Estate Development. The Agribusiness segment engages in farming and lemon packing and sales operations. This segment grows lemons, avocados, oranges, and various specialty citrus and other crops, such as Moro blood oranges, Cara Cara oranges, Minneola tangelos, Star Ruby grapefruit, pummelos, pistachios, cherries, peaches, plums, and olives, as well as packs and sells lemons grown by others. The company was founded in 1893 and is based in Santa Paula, California.

Latest LMNR News From Around the Web

Below are the latest news stories about LIMONEIRA CO that investors may wish to consider to help them evaluate LMNR as an investment opportunity.

Limoneira to Present at the 26th Annual ICR ConferenceSANTA PAULA, Calif., December 26, 2023--Limoneira Company (the "Company" or "Limoneira") (Nasdaq: LMNR), a diversified citrus growing, packing, selling and marketing company with related agribusiness activities and real estate development operations, today announced that Harold Edwards, the Company's Chief Executive Officer, and Mark Palamountain, the Company's Chief Financial Officer, will be presenting at the 26th Annual ICR Conference, to be held January 8-10, 2024, at the JW Marriot Orlando |

Limoneira Company (NASDAQ:LMNR) Q4 2023 Earnings Call TranscriptLimoneira Company (NASDAQ:LMNR) Q4 2023 Earnings Call Transcript December 21, 2023 Limoneira Company reports earnings inline with expectations. Reported EPS is $-0.15 EPS, expectations were $-0.15. LMNR isn’t one of the 30 most popular stocks among hedge funds at the end of the third quarter (see the details here). Operator: Greetings, and welcome to Limoneira’s […] |

Limoneira Company (LMNR) Q4 2023 Earnings Call TranscriptLimoneira Company (LMNR) Q4 2023 Results Conference Call December 21, 2023 04:30 PM ET Company Participants John Mills - IR, ICR Harold Edwards - President & CEO Mark Palamountain - CFO Conference Call Participants Ben Bienvenu - Stephens Ben Klieve - Lake Street Capital Markets Raj Sharma - B. Riley Securities Presentation Operator Greetings, and welcome to Limoneira's Fourth Quarter Fiscal Year 2023 Financial Results Conference Call. At this time, all participants are in a listen-only mode. A question-and-answer session will follow the formal presentation. As a reminder, this conference is being recorded. It is now my pleasure t... |

LMNR Stock Earnings: Limoneira Meets EPS, Beats Revenue for Q4 2023LMNR stock results show that Limoneira met analyst estimates for earnings per share but beat on revenue for the fourth quarter of 2023. |

Q4 2023 Limoneira Co Earnings CallQ4 2023 Limoneira Co Earnings Call |

LMNR Price Returns

| 1-mo | -4.10% |

| 3-mo | 24.46% |

| 6-mo | 13.96% |

| 1-year | 27.42% |

| 3-year | 17.06% |

| 5-year | -15.26% |

| YTD | -13.86% |

| 2023 | 72.03% |

| 2022 | -16.74% |

| 2021 | -8.26% |

| 2020 | -11.60% |

| 2019 | -0.15% |

LMNR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching LMNR

Here are a few links from around the web to help you further your research on Limoneira CO's stock as an investment opportunity:Limoneira CO (LMNR) Stock Price | Nasdaq

Limoneira CO (LMNR) Stock Quote, History and News - Yahoo Finance

Limoneira CO (LMNR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...