Pilgrim's Pride Corporation (PPC): Price and Financial Metrics

PPC Price/Volume Stats

| Current price | $27.29 | 52-week high | $29.02 |

| Prev. close | $27.14 | 52-week low | $19.96 |

| Day low | $27.01 | Volume | 325,400 |

| Day high | $27.31 | Avg. volume | 572,415 |

| 50-day MA | $27.18 | Dividend yield | N/A |

| 200-day MA | $24.69 | Market Cap | 6.46B |

PPC Stock Price Chart Interactive Chart >

PPC POWR Grades

- Sentiment is the dimension where PPC ranks best; there it ranks ahead of 91.83% of US stocks.

- PPC's strongest trending metric is Growth; it's been moving up over the last 26 weeks.

- PPC's current lowest rank is in the Momentum metric (where it is better than 0.83% of US stocks).

PPC Stock Summary

- The capital turnover (annual revenue relative to shareholder's equity) for PPC is 5.51 -- better than 91.91% of US stocks.

- PILGRIMS PRIDE CORP's stock had its IPO on December 30, 1987, making it an older stock than 89.95% of US equities in our set.

- With a price/earnings ratio of 207.55, PILGRIMS PRIDE CORP P/E ratio is greater than that of about 97.26% of stocks in our set with positive earnings.

- Stocks that are quantitatively similar to PPC, based on their financial statements, market capitalization, and price volatility, are FORR, GBR, INFU, XPO, and UTZ.

- PPC's SEC filings can be seen here. And to visit PILGRIMS PRIDE CORP's official web site, go to www.pilgrims.com.

PPC Valuation Summary

- In comparison to the median Consumer Defensive stock, PPC's price/sales ratio is 78.95% lower, now standing at 0.4.

- PPC's price/earnings ratio has moved up 186.2 over the prior 243 months.

Below are key valuation metrics over time for PPC.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| PPC | 2023-12-22 | 0.4 | 2.1 | 198.9 | 36.6 |

| PPC | 2023-12-21 | 0.4 | 2.1 | 198.5 | 36.6 |

| PPC | 2023-12-20 | 0.4 | 2.0 | 196.2 | 36.3 |

| PPC | 2023-12-19 | 0.4 | 2.0 | 196.8 | 36.4 |

| PPC | 2023-12-18 | 0.4 | 2.0 | 193.8 | 36.0 |

| PPC | 2023-12-15 | 0.4 | 2.0 | 192.6 | 35.8 |

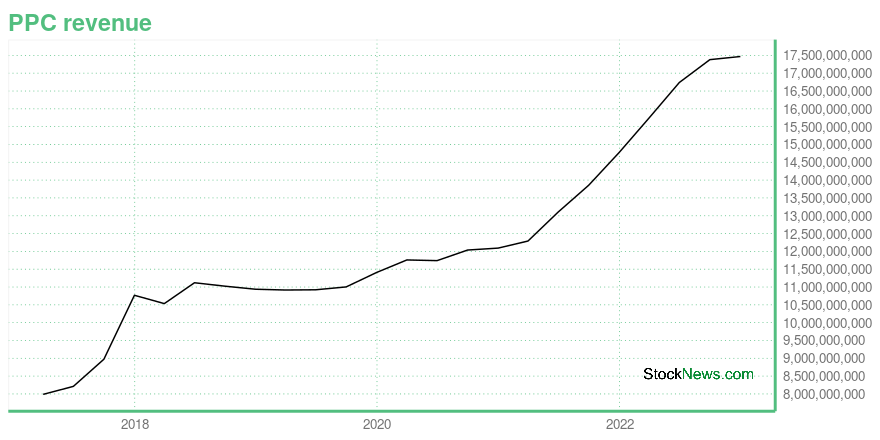

PPC Growth Metrics

- Its 4 year revenue growth rate is now at 47.2%.

- Its 2 year revenue growth rate is now at 33.89%.

- Its 3 year price growth rate is now at 6.86%.

The table below shows PPC's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 17,468.38 | 669.863 | 745.93 |

| 2022-09-30 | 17,379.78 | 789.577 | 937.66 |

| 2022-06-30 | 16,738.38 | 632.726 | 740.033 |

| 2022-03-31 | 15,744.43 | 697.006 | 211.23 |

| 2021-12-31 | 14,777.46 | 326.459 | 31 |

| 2021-09-30 | 13,856.52 | 543.407 | -5.675 |

PPC's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- PPC has a Quality Grade of C, ranking ahead of 72.59% of graded US stocks.

- PPC's asset turnover comes in at 1.757 -- ranking 10th of 59 Food Products stocks.

- ADM, RMCF, and DAR are the stocks whose asset turnover ratios are most correlated with PPC.

The table below shows PPC's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-26 | 1.757 | 0.090 | 0.032 |

| 2021-06-27 | 1.737 | 0.090 | 0.027 |

| 2021-03-28 | 1.662 | 0.075 | 0.050 |

| 2020-12-27 | 1.648 | 0.069 | 0.046 |

| 2020-09-27 | 1.661 | 0.067 | 0.061 |

| 2020-06-28 | 1.670 | 0.066 | 0.080 |

PPC Price Target

For more insight on analysts targets of PPC, see our PPC price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $27.80 | Average Broker Recommendation | 1.5 (Moderate Buy) |

Pilgrim's Pride Corporation (PPC) Company Bio

Pilgrim's Pride engages in the production, processing, marketing, and distribution of fresh, frozen, and value-added chicken products to retailers, distributors, and foodservice operators in the United States, Mexico, and Puerto Rico. The company was founded in 1946 and is based in Greeley, Colorado.

Latest PPC News From Around the Web

Below are the latest news stories about PILGRIMS PRIDE CORP that investors may wish to consider to help them evaluate PPC as an investment opportunity.

4 High Earnings Yield Value Stocks To Buy Heading Into 2024The last 12 months might have been a rollercoaster ride for investors but they have ultimately turned out to be rewarding. |

Pilgrim's Pride's (PPC) Operational Excellence Drives GrowthPilgrim's Pride's (PPC) strategic approach across global markets led to significant profitability and growth, underpinned by innovative products, strong partnerships and effective pricing strategies. |

Should Value Investors Buy Pilgrim's Pride (PPC) Stock?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

Hormel Foods (HRL) Q4 Earnings: What To ExpectPackaged foods company Hormel (NYSE:HRL) will be reporting earnings tomorrow before the bell. Here's what investors should know. |

Why Is Pilgrim's Pride (PPC) Up 6.7% Since Last Earnings Report?Pilgrim's Pride (PPC) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

PPC Price Returns

| 1-mo | -4.95% |

| 3-mo | 5.27% |

| 6-mo | 5.00% |

| 1-year | 16.08% |

| 3-year | 20.01% |

| 5-year | 34.83% |

| YTD | -1.34% |

| 2023 | 16.56% |

| 2022 | -15.85% |

| 2021 | 43.80% |

| 2020 | -40.06% |

| 2019 | 110.93% |

Continue Researching PPC

Want to do more research on Pilgrims Pride Corp's stock and its price? Try the links below:Pilgrims Pride Corp (PPC) Stock Price | Nasdaq

Pilgrims Pride Corp (PPC) Stock Quote, History and News - Yahoo Finance

Pilgrims Pride Corp (PPC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...