AMCON Distributing Company (DIT): Price and Financial Metrics

DIT Price/Volume Stats

| Current price | $193.00 | 52-week high | $249.99 |

| Prev. close | $194.39 | 52-week low | $154.04 |

| Day low | $190.00 | Volume | 100 |

| Day high | $193.00 | Avg. volume | 259 |

| 50-day MA | $189.16 | Dividend yield | 0.37% |

| 200-day MA | $198.23 | Market Cap | 121.59M |

DIT Stock Price Chart Interactive Chart >

DIT POWR Grades

- DIT scores best on the Value dimension, with a Value rank ahead of 92.43% of US stocks.

- DIT's strongest trending metric is Momentum; it's been moving up over the last 136 days.

- DIT ranks lowest in Quality; there it ranks in the 16th percentile.

DIT Stock Summary

- The capital turnover (annual revenue relative to shareholder's equity) for DIT is 24.38 -- better than 98.76% of US stocks.

- With a one year PEG ratio of 569.18, AMCON DISTRIBUTING CO is expected to have a higher PEG ratio (a measure of how expensive a stock is relative to its expected earnings growth) than 94.49% of US stocks.

- DIT's price/sales ratio is 0.05; that's higher than the P/S ratio of merely 0.85% of US stocks.

- Stocks that are quantitatively similar to DIT, based on their financial statements, market capitalization, and price volatility, are ENG, UNFI, HOUR, PFGC, and BJ.

- DIT's SEC filings can be seen here. And to visit AMCON DISTRIBUTING CO's official web site, go to www.amcon.com.

DIT Valuation Summary

- In comparison to the median Consumer Defensive stock, DIT's price/earnings ratio is 51.2% lower, now standing at 10.2.

- Over the past 243 months, DIT's price/earnings ratio has gone up 4.6.

Below are key valuation metrics over time for DIT.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| DIT | 2023-12-22 | 0 | 1.1 | 10.2 | 11.4 |

| DIT | 2023-12-21 | 0 | 1.1 | 10.1 | 11.4 |

| DIT | 2023-12-20 | 0 | 1.2 | 10.3 | 11.5 |

| DIT | 2023-12-19 | 0 | 1.1 | 10.1 | 11.4 |

| DIT | 2023-12-18 | 0 | 1.1 | 10.2 | 11.4 |

| DIT | 2023-12-15 | 0 | 1.1 | 10.2 | 11.4 |

DIT Growth Metrics

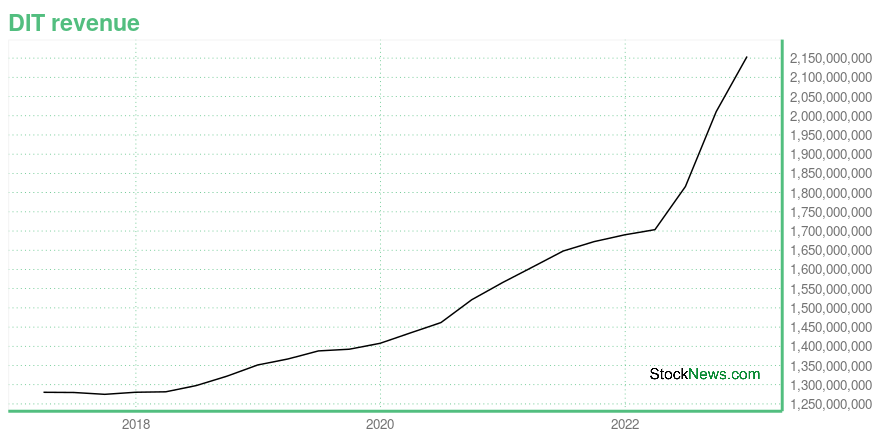

- Its 2 year revenue growth rate is now at 18.72%.

- Its 5 year net income to common stockholders growth rate is now at -67.97%.

- The 2 year net income to common stockholders growth rate now stands at 911.98%.

The table below shows DIT's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 2,154.217 | -24.97547 | 16.3002 |

| 2022-09-30 | 2,010.798 | 22.89008 | 16.67226 |

| 2022-06-30 | 1,815.851 | 15.34656 | 18.3376 |

| 2022-03-31 | 1,703.58 | 13.45191 | 16.04598 |

| 2021-12-31 | 1,690.205 | -6.372926 | 15.46871 |

| 2021-09-30 | 1,672.379 | 20.93564 | 15.54527 |

DIT's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- DIT has a Quality Grade of C, ranking ahead of 30.64% of graded US stocks.

- DIT's asset turnover comes in at 9.336 -- ranking 1st of 105 Wholesale stocks.

- NGL, MSM, and SPRS are the stocks whose asset turnover ratios are most correlated with DIT.

The table below shows DIT's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 9.336 | 0.059 | 0.086 |

| 2021-03-31 | 9.257 | 0.058 | 0.074 |

| 2020-12-31 | 9.124 | 0.058 | 0.063 |

| 2020-09-30 | 8.997 | 0.058 | 0.047 |

| 2020-06-30 | 9.050 | 0.058 | 0.030 |

| 2020-03-31 | 9.454 | 0.059 | 0.026 |

AMCON Distributing Company (DIT) Company Bio

AMCON Distributing Company, together with its subsidiaries, engages in the wholesale distribution of consumer products in the Central, Rocky Mountain, and Mid-South regions of the United States. It operates in two segments, Wholesale Distribution and Retail Health Food. The Wholesale Distribution segment distributes consumer products, including cigarettes and tobacco products, candy and other confectionery, beverages, groceries, paper products, health and beauty care products, frozen and refrigerated products, and institutional foodservice products. It serves retailers, such as convenience stores, discount and general merchandise stores, grocery stores, drug stores, liquor stores, tobacco shops, and gas stations; and institutional customers, including restaurants and bars, schools, and sports complexes, as well as other wholesalers. This segment also markets private label lines of water, candy products, batteries, and other products. The Retail Health Food segment is involved in the retail of natural, organic, and specialty foods consisting of produce, baked goods, frozen foods, nutritional supplements, personal care items, and general merchandise. As of November 9, 2020, it operated 21 retail health food stores under the Chamberlin's Natural Foods, Akin's Natural Foods, and Earth Origins Market brands. AMCON Distributing Company was incorporated in 1986 and is based in Omaha, Nebraska.

Latest DIT News From Around the Web

Below are the latest news stories about AMCON DISTRIBUTING CO that investors may wish to consider to help them evaluate DIT as an investment opportunity.

AMCON Distributing declares $0.28 special dividendMore on AMCON Distributing... |

AMCON Distributing Company Announces $0.28 Special DividendOMAHA, Neb., December 27, 2023--AMCON Distributing Company ("AMCON") (NYSE American: DIT), an Omaha, Nebraska-based consumer products company is pleased to announce that the Board of Directors of AMCON declared a special cash dividend of $0.28 per common share. This cash dividend is payable on January 17, 2024 to shareholders of record as of January 8, 2024. |

AMCON Distributing Company Reports Results for the Fiscal Year Ended September 30, 2023OMAHA, Neb., November 08, 2023--AMCON Distributing Company ("AMCON" or "the Company") (NYSE American: DIT), an Omaha, Nebraska based consumer products company, is pleased to announce fully diluted earnings per share of $19.46 on net income available to common shareholders of $11.6 million for the fiscal year ended September 30, 2023. |

AMCON Distributing Company Announces $0.18 Quarterly DividendOMAHA, Neb., October 24, 2023--AMCON Distributing Company ("AMCON") (NYSE American: DIT), an Omaha, Nebraska-based consumer products company is pleased to announce that the Board of Directors of AMCON declared a quarterly cash dividend of $0.18 per common share. This cash dividend is payable on November 17, 2023 to shareholders of record as of November 6, 2023. |

AMCON Distributing Company Reports Results for the Quarter Ended June 30, 2023OMAHA, Neb., July 18, 2023--AMCON Distributing Company ("AMCON" or "Company") (NYSE American: DIT), an Omaha, Nebraska based consumer products company, is pleased to announce fully diluted earnings per share of $6.59 on net income available to common shareholders of $3.9 million for its third fiscal quarter ended June 30, 2023. |

DIT Price Returns

| 1-mo | -1.92% |

| 3-mo | 6.89% |

| 6-mo | -13.24% |

| 1-year | 16.85% |

| 3-year | 89.63% |

| 5-year | 148.73% |

| YTD | -0.79% |

| 2023 | 8.14% |

| 2022 | -6.44% |

| 2021 | 73.39% |

| 2020 | 74.59% |

| 2019 | -26.99% |

DIT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching DIT

Here are a few links from around the web to help you further your research on Amcon Distributing Co's stock as an investment opportunity:Amcon Distributing Co (DIT) Stock Price | Nasdaq

Amcon Distributing Co (DIT) Stock Quote, History and News - Yahoo Finance

Amcon Distributing Co (DIT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...