Kraft Heinz Co. (KHC): Price and Financial Metrics

KHC Price/Volume Stats

| Current price | $36.47 | 52-week high | $41.47 |

| Prev. close | $36.40 | 52-week low | $30.68 |

| Day low | $36.23 | Volume | 10,685,400 |

| Day high | $36.68 | Avg. volume | 8,172,704 |

| 50-day MA | $36.92 | Dividend yield | 4.3% |

| 200-day MA | $35.63 | Market Cap | 44.73B |

KHC Stock Price Chart Interactive Chart >

KHC POWR Grades

- KHC scores best on the Stability dimension, with a Stability rank ahead of 64.12% of US stocks.

- The strongest trend for KHC is in Growth, which has been heading down over the past 26 weeks.

- KHC ranks lowest in Momentum; there it ranks in the 13th percentile.

KHC Stock Summary

- KHC has a market capitalization of $46,706,593,468 -- more than approximately 94.59% of US stocks.

- Of note is the ratio of KRAFT HEINZ CO's sales and general administrative expense to its total operating expenses; 87.34% of US stocks have a lower such ratio.

- Over the past twelve months, KHC has reported earnings growth of 72.52%, putting it ahead of 86.62% of US stocks in our set.

- Stocks with similar financial metrics, market capitalization, and price volatility to KRAFT HEINZ CO are STZ, CRH, HSY, TT, and DHI.

- KHC's SEC filings can be seen here. And to visit KRAFT HEINZ CO's official web site, go to www.kraftheinzcompany.com.

KHC Valuation Summary

- In comparison to the median Consumer Defensive stock, KHC's EV/EBIT ratio is 21.49% lower, now standing at 13.7.

- KHC's price/sales ratio has moved down 7.5 over the prior 102 months.

Below are key valuation metrics over time for KHC.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| KHC | 2023-12-22 | 1.6 | 0.9 | 14.9 | 13.7 |

| KHC | 2023-12-21 | 1.6 | 0.9 | 14.8 | 13.5 |

| KHC | 2023-12-20 | 1.6 | 0.9 | 14.7 | 13.5 |

| KHC | 2023-12-19 | 1.6 | 0.9 | 15.0 | 13.7 |

| KHC | 2023-12-18 | 1.7 | 0.9 | 15.1 | 13.7 |

| KHC | 2023-12-15 | 1.7 | 0.9 | 15.0 | 13.7 |

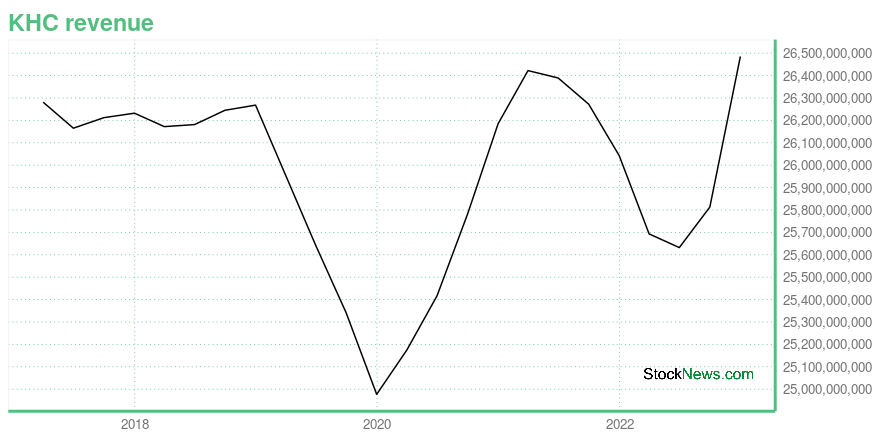

KHC Growth Metrics

- Its 3 year cash and equivalents growth rate is now at 105.1%.

- Its 2 year net cashflow from operations growth rate is now at 45.66%.

- The 3 year price growth rate now stands at 67.99%.

The table below shows KHC's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 26,485 | 2,469 | 2,363 |

| 2022-09-30 | 25,813 | 4,433 | 1,216 |

| 2022-06-30 | 25,632 | 4,123 | 1,517 |

| 2022-03-31 | 25,693 | 5,040 | 1,225 |

| 2021-12-31 | 26,042 | 5,364 | 1,012 |

| 2021-09-30 | 26,272 | 4,051 | 2,301 |

KHC's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- KHC has a Quality Grade of C, ranking ahead of 42.49% of graded US stocks.

- KHC's asset turnover comes in at 0.269 -- ranking 51st of 59 Food Products stocks.

- BRID, SENEA, and JJSF are the stocks whose asset turnover ratios are most correlated with KHC.

The table below shows KHC's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-25 | 0.269 | 0.344 | 0.150 |

| 2021-06-26 | 0.268 | 0.355 | 0.143 |

| 2021-03-27 | 0.268 | 0.360 | 0.072 |

| 2020-12-26 | 0.262 | 0.350 | 0.065 |

| 2020-09-26 | 0.257 | 0.340 | 0.039 |

| 2020-06-27 | 0.250 | 0.329 | 0.048 |

KHC Price Target

For more insight on analysts targets of KHC, see our KHC price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $40.86 | Average Broker Recommendation | 1.89 (Hold) |

Kraft Heinz Co. (KHC) Company Bio

The Kraft Heinz Company (KHC), commonly known as Kraft Heinz, is an American multinational food company formed by the merger of Kraft Foods and Heinz co-headquartered in Chicago, Illinois, and Pittsburgh, Pennsylvania. Kraft Heinz is the third-largest food and beverage company in North America and the fifth-largest in the world with over $26.0 billion in annual sales as of 2020. (Source:Wikipedia)

Latest KHC News From Around the Web

Below are the latest news stories about KRAFT HEINZ CO that investors may wish to consider to help them evaluate KHC as an investment opportunity.

The Zacks Analyst Blog Highlights Molson Coors Beverage, The Procter & Gamble, The Coca-Cola and The Kraft HeinzMolson Coors Beverage, The Procter & Gamble, The Coca-Cola and The Kraft Heinz are part of the Zacks top Analyst Blog. |

Time to Buy Kraft Heinz (KHC) and Ingredion's (INGR) Stock for ValueGenerous dividends, very reasonable valuations, and favorable outlooks certainly make Kraft Heinz (KHC) and Ingredion (INGR) two of the more attractive consumer staples stocks for the new year. |

The 7 Highest-Yielding Dividend Gems in Warren Buffet’s CrownWarren Buffett doesn’t hide the fact he loves dividends. |

How Food Stocks Spoiled in 2023Companies making packaged food were among the most notable U.S. stock underperformers of the year, and the causes were many. Next year might look better. |

Hershey's bitter ending to 2023 shows innovation will be key to success in 2024, says analystThe Consumer Staples Select Sector is also under pressure. |

KHC Price Returns

| 1-mo | -5.40% |

| 3-mo | 12.16% |

| 6-mo | 8.06% |

| 1-year | -2.42% |

| 3-year | 22.14% |

| 5-year | -2.84% |

| YTD | -1.38% |

| 2023 | -5.04% |

| 2022 | 18.18% |

| 2021 | 7.98% |

| 2020 | 13.78% |

| 2019 | -21.20% |

KHC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching KHC

Want to see what other sources are saying about Kraft Heinz Co's financials and stock price? Try the links below:Kraft Heinz Co (KHC) Stock Price | Nasdaq

Kraft Heinz Co (KHC) Stock Quote, History and News - Yahoo Finance

Kraft Heinz Co (KHC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...