Accelerate Diagnostics, Inc. (AXDX): Price and Financial Metrics

AXDX Price/Volume Stats

| Current price | $1.29 | 52-week high | $11.90 |

| Prev. close | $1.16 | 52-week low | $0.92 |

| Day low | $1.15 | Volume | 179,100 |

| Day high | $1.33 | Avg. volume | 209,952 |

| 50-day MA | $3.23 | Dividend yield | N/A |

| 200-day MA | $5.90 | Market Cap | 18.79M |

AXDX Stock Price Chart Interactive Chart >

AXDX POWR Grades

- Sentiment is the dimension where AXDX ranks best; there it ranks ahead of 91.13% of US stocks.

- The strongest trend for AXDX is in Sentiment, which has been heading up over the past 26 weeks.

- AXDX ranks lowest in Momentum; there it ranks in the 7th percentile.

AXDX Stock Summary

- Equity multiplier, or assets relative to shareholders' equity, comes in at -1.52 for ACCELERATE DIAGNOSTICS INC; that's greater than it is for only 5.54% of US stocks.

- With a year-over-year growth in debt of -52.45%, ACCELERATE DIAGNOSTICS INC's debt growth rate surpasses merely 4.69% of about US stocks.

- In terms of volatility of its share price, AXDX is more volatile than 95.33% of stocks we're observing.

- Stocks with similar financial metrics, market capitalization, and price volatility to ACCELERATE DIAGNOSTICS INC are MRIN, INSG, OVID, IVAC, and ACLS.

- Visit AXDX's SEC page to see the company's official filings. To visit the company's web site, go to acceleratediagnostics.com.

AXDX Valuation Summary

- In comparison to the median Healthcare stock, AXDX's EV/EBIT ratio is 108.9% lower, now standing at -1.3.

- Over the past 243 months, AXDX's price/sales ratio has gone down 34.7.

Below are key valuation metrics over time for AXDX.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| AXDX | 2023-12-29 | 4.7 | -1.6 | -0.9 | -1.3 |

| AXDX | 2023-12-28 | 4.8 | -1.7 | -0.9 | -1.3 |

| AXDX | 2023-12-27 | 5.1 | -1.7 | -1.0 | -1.4 |

| AXDX | 2023-12-26 | 5.0 | -1.7 | -1.0 | -1.4 |

| AXDX | 2023-12-22 | 5.2 | -1.8 | -1.0 | -1.4 |

| AXDX | 2023-12-21 | 5.2 | -1.8 | -1.0 | -1.4 |

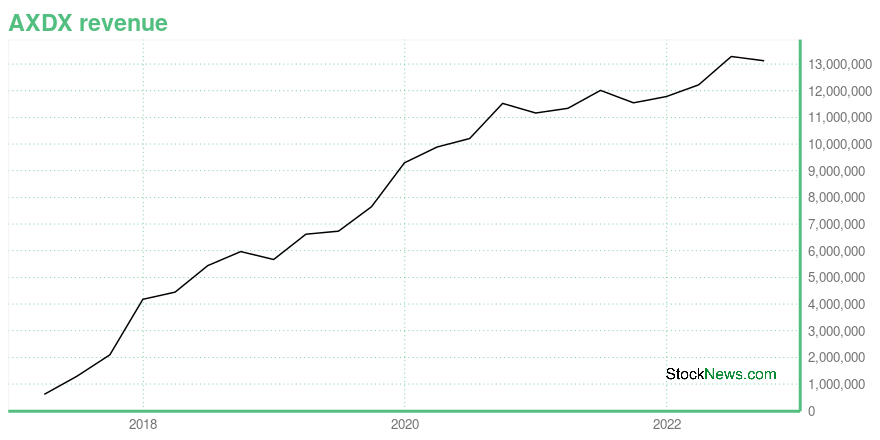

AXDX Growth Metrics

- The 4 year revenue growth rate now stands at 1513.21%.

- Its year over year revenue growth rate is now at 7.77%.

- Its 4 year cash and equivalents growth rate is now at 298.17%.

The table below shows AXDX's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 13.122 | -51.125 | -70.496 |

| 2022-06-30 | 13.284 | -50 | -63.777 |

| 2022-03-31 | 12.221 | -46.554 | -67.648 |

| 2021-12-31 | 11.782 | -47.323 | -77.702 |

| 2021-09-30 | 11.547 | -45.719 | -73.811 |

| 2021-06-30 | 12.013 | -45.927 | -83.582 |

AXDX's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- AXDX has a Quality Grade of D, ranking ahead of 23.75% of graded US stocks.

- AXDX's asset turnover comes in at 0.125 -- ranking 68th of 75 Measuring and Control Equipment stocks.

- AATC, TMO, and BMI are the stocks whose asset turnover ratios are most correlated with AXDX.

The table below shows AXDX's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.125 | 0.366 | -0.333 |

| 2021-03-31 | 0.112 | 0.379 | -0.320 |

| 2020-12-31 | 0.103 | 0.399 | -0.302 |

| 2020-09-30 | 0.097 | 0.418 | -0.316 |

| 2020-06-30 | 0.079 | 0.458 | -0.343 |

| 2020-03-31 | 0.071 | 0.467 | -0.358 |

AXDX Price Target

For more insight on analysts targets of AXDX, see our AXDX price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $13.00 | Average Broker Recommendation | 1.7 (Moderate Buy) |

Accelerate Diagnostics, Inc. (AXDX) Company Bio

Accelerate Diagnostics is an in vitro diagnostics company focused on developing and commercializing innovative systems for the rapid identification and antimicrobial susceptibility testing of infectious pathogens. The company was founded in 1982 and is based in Tucson, Arizona.

Latest AXDX News From Around the Web

Below are the latest news stories about ACCELERATE DIAGNOSTICS INC that investors may wish to consider to help them evaluate AXDX as an investment opportunity.

Accelerate Diagnostics (AXDX) Expands in In Vitro DiagnosticsAccelerate Diagnostics' (AXDX) Arc system eliminates the need for overnight culture incubation, drastically reducing the wait time for identification results. |

Bruker's (BRKR) New Collaboration to Use MALDI Biotyper SystemBruker (BRKR) and Accelerate Diagnostics are set to work together to bring rapid, automated microbial identification directly from positive blood culture samples. |

Accelerate Diagnostics Announces Collaboration for the Use of the Arc™ System in Combination With Bruker´s MALDI Biotyper®Accelerate Diagnostics, Inc. (NASDAQ: AXDX) an innovator of rapid in vitro diagnostics in microbiology, announced the signing of a collaboration and quality agreement with Bruker Corporation (NASDAQ: BRKR), the provider of the market-leading MALDI Biotyper system for microbial identification. This agreement enables both companies to validate the use of Accelerate Diagnostics' Arc™ system, an innovative, automated positive blood culture sample preparation platform, with Bruker's MALDI Biotyper® s |

Accelerate Diagnostics (AXDX) Loses -25.65% in 4 Weeks, Here's Why a Trend Reversal May be Around the CornerAccelerate Diagnostics (AXDX) is technically in oversold territory now, so the heavy selling pressure might have exhausted. This along with strong agreement among Wall Street analysts in raising earnings estimates could lead to a trend reversal for the stock. |

Accelerate Diagnostics, Inc. (NASDAQ:AXDX) Q3 2023 Earnings Call TranscriptAccelerate Diagnostics, Inc. (NASDAQ:AXDX) Q3 2023 Earnings Call Transcript November 9, 2023 Accelerate Diagnostics, Inc. beats earnings expectations. Reported EPS is $0.14, expectations were $-0.94. Operator: Good day, and welcome to the Accelerate Diagnostics, Inc. 2023 Third Quarter Results Conference Call. All participant’s will be in listen-only mode. After today’s presentation, there will be a […] |

AXDX Price Returns

| 1-mo | -66.92% |

| 3-mo | -77.49% |

| 6-mo | -81.70% |

| 1-year | -80.74% |

| 3-year | -99.03% |

| 5-year | -99.32% |

| YTD | -67.09% |

| 2023 | -44.48% |

| 2022 | -86.48% |

| 2021 | -31.13% |

| 2020 | -55.15% |

| 2019 | 46.96% |

Continue Researching AXDX

Want to see what other sources are saying about Accelerate Diagnostics Inc's financials and stock price? Try the links below:Accelerate Diagnostics Inc (AXDX) Stock Price | Nasdaq

Accelerate Diagnostics Inc (AXDX) Stock Quote, History and News - Yahoo Finance

Accelerate Diagnostics Inc (AXDX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...