Cavco Industries, Inc. (CVCO): Price and Financial Metrics

CVCO Price/Volume Stats

| Current price | $354.00 | 52-week high | $365.63 |

| Prev. close | $349.13 | 52-week low | $233.84 |

| Day low | $351.13 | Volume | 59,600 |

| Day high | $355.60 | Avg. volume | 66,978 |

| 50-day MA | $325.26 | Dividend yield | N/A |

| 200-day MA | $289.40 | Market Cap | 2.95B |

CVCO Stock Price Chart Interactive Chart >

CVCO POWR Grades

- CVCO scores best on the Momentum dimension, with a Momentum rank ahead of 99.98% of US stocks.

- CVCO's strongest trending metric is Growth; it's been moving down over the last 26 weeks.

- CVCO's current lowest rank is in the Growth metric (where it is better than 9.94% of US stocks).

CVCO Stock Summary

- Of note is the ratio of CAVCO INDUSTRIES INC's sales and general administrative expense to its total operating expenses; 87.34% of US stocks have a lower such ratio.

- The ratio of debt to operating expenses for CAVCO INDUSTRIES INC is higher than it is for about just 16.09% of US stocks.

- With a year-over-year growth in debt of 148.43%, CAVCO INDUSTRIES INC's debt growth rate surpasses 94.12% of about US stocks.

- Stocks with similar financial metrics, market capitalization, and price volatility to CAVCO INDUSTRIES INC are DNOW, ZYXI, LAKE, HGBL, and DYNT.

- Visit CVCO's SEC page to see the company's official filings. To visit the company's web site, go to www.cavco.com.

CVCO Valuation Summary

- CVCO's EV/EBIT ratio is 10.2; this is 33.33% lower than that of the median Consumer Cyclical stock.

- CVCO's EV/EBIT ratio has moved up 22.6 over the prior 243 months.

Below are key valuation metrics over time for CVCO.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| CVCO | 2023-12-29 | 1.5 | 2.8 | 14.8 | 10.2 |

| CVCO | 2023-12-28 | 1.5 | 2.9 | 15.1 | 10.4 |

| CVCO | 2023-12-27 | 1.6 | 2.9 | 15.2 | 10.5 |

| CVCO | 2023-12-26 | 1.6 | 2.9 | 15.3 | 10.6 |

| CVCO | 2023-12-22 | 1.5 | 2.8 | 14.9 | 10.2 |

| CVCO | 2023-12-21 | 1.5 | 2.8 | 14.8 | 10.2 |

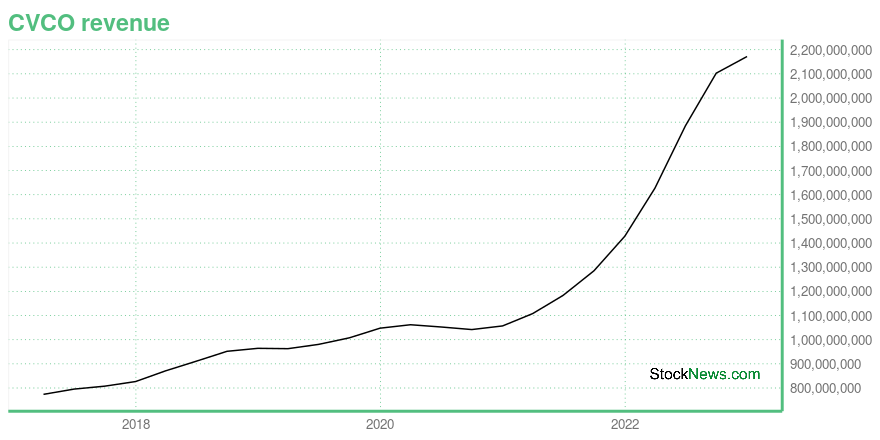

CVCO Growth Metrics

- Its year over year revenue growth rate is now at 46.85%.

- Its 4 year cash and equivalents growth rate is now at 76.48%.

- The year over year price growth rate now stands at 0.4%.

The table below shows CVCO's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 2,171.812 | 248.376 | 246.866 |

| 2022-09-30 | 2,102.923 | 227.079 | 266.761 |

| 2022-06-30 | 1,885.074 | 178.189 | 230.255 |

| 2022-03-31 | 1,627.158 | 144.224 | 197.699 |

| 2021-12-31 | 1,428.181 | 148.432 | 169.297 |

| 2021-09-30 | 1,285.239 | 119.509 | 109.579 |

CVCO's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- CVCO has a Quality Grade of C, ranking ahead of 70.09% of graded US stocks.

- CVCO's asset turnover comes in at 1.276 -- ranking 9th of 60 Construction Materials stocks.

- OFLX, RUN, and PRLB are the stocks whose asset turnover ratios are most correlated with CVCO.

The table below shows CVCO's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-07-03 | 1.276 | 0.218 | 0.371 |

| 2021-04-03 | 1.238 | 0.216 | 0.327 |

| 2020-12-26 | 1.230 | 0.208 | 0.272 |

| 2020-09-26 | 1.256 | 0.212 | 0.260 |

| 2020-06-27 | 1.312 | 0.214 | 0.275 |

| 2020-03-28 | 1.358 | 0.217 | 0.289 |

CVCO Price Target

For more insight on analysts targets of CVCO, see our CVCO price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $278.33 | Average Broker Recommendation | 1.67 (Moderate Buy) |

Cavco Industries, Inc. (CVCO) Company Bio

Cavco Industries Inc. engages in the design, production, wholesale, and retail sale of manufactured homes in the United States under the Cavco Homes, Fleetwood Homes, Palm Harbor Homes, Fairmont Homes, and Chariot Eagle brands. It operates through two segments, Factory-Built Housing and Financial Services. The company markets its manufactured homes. The company was founded in 1965 and is based in Phoenix, Arizona.

Latest CVCO News From Around the Web

Below are the latest news stories about CAVCO INDUSTRIES INC that investors may wish to consider to help them evaluate CVCO as an investment opportunity.

Cavco Releases First HUD-Approved Manufactured Duplex HomesNew Anthem Duplex Doubles Down on Innovation, Affordability and Investment Returns Anthem Duplex Series by Cavco Homes Anthem Duplex Series by Cavco Homes Anthem Duplex Series by Cavco Homes Anthem Duplex Series by Cavco Homes PHOENIX, Dec. 12, 2023 (GLOBE NEWSWIRE) -- Cavco Industries, Inc. (Nasdaq: CVCO) (“Cavco” or the “Company”) is proud to announce a significant innovation in the manufactured home industry with the launch of the first nationally available, manufactured duplex approved by th |

Is Cavco Industries, Inc. (NASDAQ:CVCO) Trading At A 46% Discount?Key Insights The projected fair value for Cavco Industries is US$570 based on 2 Stage Free Cash Flow to Equity Cavco... |

Insider Sell Alert: Senior Vice President Steven Like Sells Shares of Cavco Industries IncIn the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. |

Insider Sell Alert: Director Steven Bunger Sells 4,000 Shares of Cavco Industries Inc (CVCO)Director Steven Bunger of Cavco Industries Inc (NASDAQ:CVCO) has recently sold 4,000 shares of the company's stock, according to the latest SEC filings. |

Is Weakness In Cavco Industries, Inc. (NASDAQ:CVCO) Stock A Sign That The Market Could be Wrong Given Its Strong Financial Prospects?With its stock down 11% over the past three months, it is easy to disregard Cavco Industries (NASDAQ:CVCO). However, a... |

CVCO Price Returns

| 1-mo | 11.07% |

| 3-mo | 36.83% |

| 6-mo | 20.64% |

| 1-year | 22.08% |

| 3-year | 64.68% |

| 5-year | 153.65% |

| YTD | 2.13% |

| 2023 | 53.20% |

| 2022 | -28.77% |

| 2021 | 81.05% |

| 2020 | -10.20% |

| 2019 | 49.85% |

Continue Researching CVCO

Here are a few links from around the web to help you further your research on Cavco Industries Inc's stock as an investment opportunity:Cavco Industries Inc (CVCO) Stock Price | Nasdaq

Cavco Industries Inc (CVCO) Stock Quote, History and News - Yahoo Finance

Cavco Industries Inc (CVCO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...