NeoGenomics, Inc. (NEO): Price and Financial Metrics

NEO Price/Volume Stats

| Current price | $14.50 | 52-week high | $21.22 |

| Prev. close | $14.06 | 52-week low | $11.03 |

| Day low | $13.77 | Volume | 1,121,600 |

| Day high | $14.78 | Avg. volume | 881,722 |

| 50-day MA | $17.08 | Dividend yield | N/A |

| 200-day MA | $15.87 | Market Cap | 1.85B |

NEO Stock Price Chart Interactive Chart >

NEO POWR Grades

- Growth is the dimension where NEO ranks best; there it ranks ahead of 93.98% of US stocks.

- NEO's strongest trending metric is Growth; it's been moving up over the last 26 weeks.

- NEO ranks lowest in Value; there it ranks in the 10th percentile.

NEO Stock Summary

- Of note is the ratio of NEOGENOMICS INC's sales and general administrative expense to its total operating expenses; 70.56% of US stocks have a lower such ratio.

- NEO's price/sales ratio is 3.57; that's higher than the P/S ratio of 70.17% of US stocks.

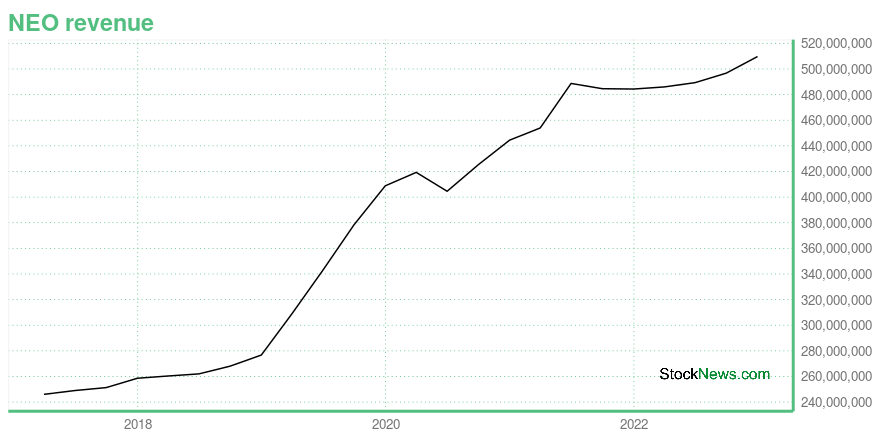

- Revenue growth over the past 12 months for NEOGENOMICS INC comes in at 15.71%, a number that bests 71.2% of the US stocks we're tracking.

- If you're looking for stocks that are quantitatively similar to NEOGENOMICS INC, a group of peers worth examining would be AMRN, AVNS, CDXC, ANGI, and KIDS.

- NEO's SEC filings can be seen here. And to visit NEOGENOMICS INC's official web site, go to www.neogenomics.com.

NEO Valuation Summary

- In comparison to the median Healthcare stock, NEO's price/sales ratio is 14.29% lower, now standing at 3.6.

- Over the past 241 months, NEO's price/sales ratio has gone down 17.8.

Below are key valuation metrics over time for NEO.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| NEO | 2023-12-29 | 3.6 | 2.2 | -21.4 | -20.5 |

| NEO | 2023-12-28 | 3.7 | 2.3 | -22.2 | -21.2 |

| NEO | 2023-12-27 | 4.5 | 2.8 | -27.1 | -25.3 |

| NEO | 2023-12-26 | 4.6 | 2.8 | -27.2 | -25.4 |

| NEO | 2023-12-22 | 4.6 | 2.8 | -27.4 | -25.6 |

| NEO | 2023-12-21 | 4.6 | 2.8 | -27.2 | -25.4 |

NEO Growth Metrics

- Its 4 year net income to common stockholders growth rate is now at 112.24%.

- Its 4 year net cashflow from operations growth rate is now at -18.8%.

- Its 2 year net cashflow from operations growth rate is now at -660.72%.

The table below shows NEO's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 509.728 | -65.993 | -144.25 |

| 2022-09-30 | 496.755 | -82.084 | -163.322 |

| 2022-06-30 | 489.313 | -73.579 | -146.818 |

| 2022-03-31 | 485.965 | -57.973 | -35.642 |

| 2021-12-31 | 484.329 | -26.723 | -8.347 |

| 2021-09-30 | 484.594 | -0.962 | 48.828 |

NEO's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- NEO has a Quality Grade of C, ranking ahead of 30.23% of graded US stocks.

- NEO's asset turnover comes in at 0.366 -- ranking 397th of 561 Business Services stocks.

- MSFT, VRNS, and SGRP are the stocks whose asset turnover ratios are most correlated with NEO.

The table below shows NEO's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.366 | 0.422 | 0.085 |

| 2021-03-31 | 0.414 | 0.399 | -0.033 |

| 2020-12-31 | 0.490 | 0.418 | -0.014 |

| 2020-09-30 | 0.508 | 0.419 | -0.033 |

| 2020-06-30 | 0.522 | 0.433 | -0.042 |

| 2020-03-31 | 0.589 | 0.468 | 0.016 |

NEO Price Target

For more insight on analysts targets of NEO, see our NEO price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $56.80 | Average Broker Recommendation | 1.25 (Strong Buy) |

NeoGenomics, Inc. (NEO) Company Bio

NeoGenomics, Inc. operates a network of cancer-focused testing laboratories providing genetic and molecular testing services to hospitals, pathologists, oncologists, urologists, other clinicians and researchers, and other laboratories in the United States. The company was founded in 2001 and is based in Fort Myers, Florida.

Latest NEO News From Around the Web

Below are the latest news stories about NEOGENOMICS INC that investors may wish to consider to help them evaluate NEO as an investment opportunity.

S&P 500 Misses Out On Record As Stock Market Fades Late; Small Caps On Pace For Record DecemberThe S&P 500 came within inches of a record high Thursday, but had to settle for a minute gain as the stock market faded and small caps broke a trend of outperformance. The S&P 500 climbed less than 0.1%. The Nasdaq composite closed fractionally lower after erasing modest gains. |

NeoGenomics to Appeal RulingFORT MYERS, FL / ACCESSWIRE / December 28, 2023 / NeoGenomics, Inc. (NASDAQ:NEO) (the "Company"), a leading oncology testing services company, today announced that NeoGenomics Laboratories, Inc., a subsidiary of NeoGenomics Inc., will appeal the preliminary ... |

NeoGenomics to Present New Data at San Antonio Breast Cancer Symposium Highlighting Utility of RaDaR for Therapy ResponseFT. MYERS, FL / ACCESSWIRE / December 5, 2023 / NeoGenomics, Inc. (NASDAQ:NEO), a leading oncology testing services company, today announced new data highlighting its RaDaR® assay for minimal residual disease (MRD) will be presented at the 46th annual ... |

NeoGenomics to Participate at the Piper Sandler 35th Annual Healthcare ConferenceFT. MYERS, FL / ACCESSWIRE / November 14, 2023 / NeoGenomics, Inc. (NASDAQ:NEO), a leading oncology testing services company, today announced the company will participate in the upcoming Piper Sandler 35th Annual Global Healthcare Conference in New ... |

Wall Street Analysts See a 28.17% Upside in NeoGenomics (NEO): Can the Stock Really Move This High?The average of price targets set by Wall Street analysts indicates a potential upside of 28.2% in NeoGenomics (NEO). While the effectiveness of this highly sought-after metric is questionable, the positive trend in earnings estimate revisions might translate into an upside in the stock. |

NEO Price Returns

| 1-mo | -10.05% |

| 3-mo | -7.99% |

| 6-mo | 3.13% |

| 1-year | 20.13% |

| 3-year | -74.13% |

| 5-year | -12.33% |

| YTD | -10.38% |

| 2023 | 75.11% |

| 2022 | -72.92% |

| 2021 | -36.63% |

| 2020 | 84.07% |

| 2019 | 131.96% |

Continue Researching NEO

Here are a few links from around the web to help you further your research on Neogenomics Inc's stock as an investment opportunity:Neogenomics Inc (NEO) Stock Price | Nasdaq

Neogenomics Inc (NEO) Stock Quote, History and News - Yahoo Finance

Neogenomics Inc (NEO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...