Hawkins, Inc. (HWKN): Price and Financial Metrics

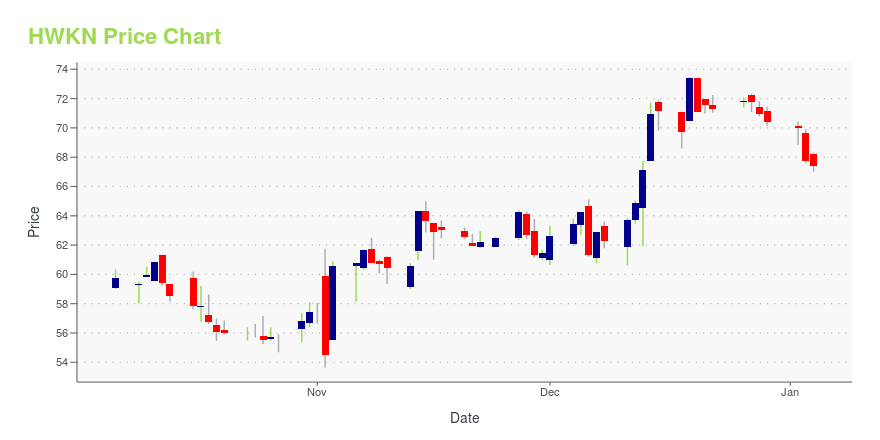

HWKN Price/Volume Stats

| Current price | $61.41 | 52-week high | $73.47 |

| Prev. close | $60.00 | 52-week low | $38.05 |

| Day low | $60.02 | Volume | 233,000 |

| Day high | $61.76 | Avg. volume | 103,522 |

| 50-day MA | $66.16 | Dividend yield | 1.08% |

| 200-day MA | $56.22 | Market Cap | 1.29B |

HWKN Stock Price Chart Interactive Chart >

HWKN POWR Grades

- Quality is the dimension where HWKN ranks best; there it ranks ahead of 74.99% of US stocks.

- HWKN's strongest trending metric is Quality; it's been moving up over the last 26 weeks.

- HWKN ranks lowest in Momentum; there it ranks in the 19th percentile.

HWKN Stock Summary

- HAWKINS INC's stock had its IPO on October 27, 1993, making it an older stock than 77.68% of US equities in our set.

- Of note is the ratio of HAWKINS INC's sales and general administrative expense to its total operating expenses; 87.34% of US stocks have a lower such ratio.

- With a year-over-year growth in debt of -54.1%, HAWKINS INC's debt growth rate surpasses merely 4.54% of about US stocks.

- If you're looking for stocks that are quantitatively similar to HAWKINS INC, a group of peers worth examining would be ACU, CSWI, JBSS, APOG, and CLFD.

- HWKN's SEC filings can be seen here. And to visit HAWKINS INC's official web site, go to www.hawkinsinc.com.

HWKN Valuation Summary

- In comparison to the median Basic Materials stock, HWKN's price/earnings ratio is 28.14% higher, now standing at 21.4.

- Over the past 243 months, HWKN's price/sales ratio has gone up 0.3.

Below are key valuation metrics over time for HWKN.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| HWKN | 2023-12-29 | 1.6 | 3.9 | 21.4 | 15.3 |

| HWKN | 2023-12-28 | 1.6 | 3.9 | 21.5 | 15.4 |

| HWKN | 2023-12-27 | 1.6 | 3.9 | 21.8 | 15.6 |

| HWKN | 2023-12-26 | 1.6 | 3.9 | 21.8 | 15.6 |

| HWKN | 2023-12-22 | 1.6 | 3.9 | 21.6 | 15.5 |

| HWKN | 2023-12-21 | 1.6 | 3.9 | 21.7 | 15.5 |

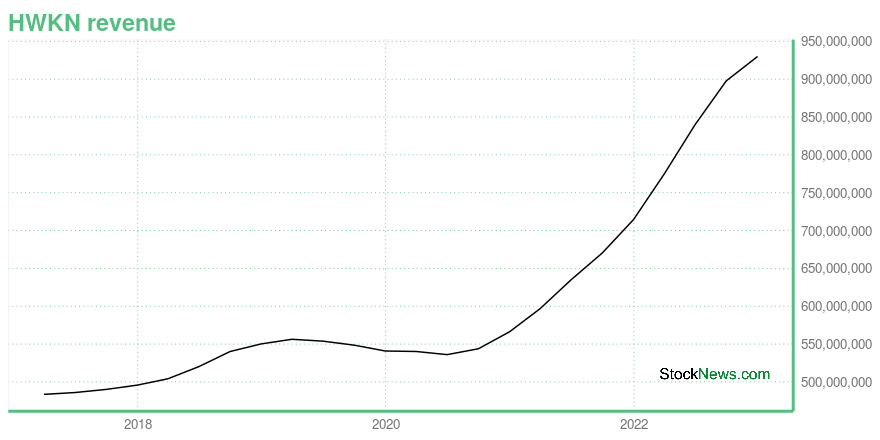

HWKN Growth Metrics

- Its 2 year price growth rate is now at 105.03%.

- The year over year net cashflow from operations growth rate now stands at -2.18%.

- Its 3 year net income to common stockholders growth rate is now at 110.95%.

The table below shows HWKN's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 929.926 | 48.669 | 59.005 |

| 2022-09-30 | 897.758 | 21.558 | 58.476 |

| 2022-06-30 | 839.843 | 18.621 | 54.609 |

| 2022-03-31 | 774.541 | 42.837 | 51.542 |

| 2021-12-31 | 714.539 | 55.896 | 50.046 |

| 2021-09-30 | 670.416 | 63.737 | 47.763 |

HWKN's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- HWKN has a Quality Grade of C, ranking ahead of 64.92% of graded US stocks.

- HWKN's asset turnover comes in at 1.433 -- ranking 56th of 105 Wholesale stocks.

- WSTG, HLF, and MEDS are the stocks whose asset turnover ratios are most correlated with HWKN.

The table below shows HWKN's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-26 | 1.433 | 0.203 | 0.186 |

| 2021-06-27 | 1.398 | 0.208 | 0.183 |

| 2021-03-28 | 1.371 | 0.207 | 0.175 |

| 2020-12-27 | 1.366 | 0.202 | 0.169 |

| 2020-09-27 | 1.361 | 0.198 | 0.164 |

| 2020-06-28 | 1.367 | 0.192 | 0.152 |

HWKN Price Target

For more insight on analysts targets of HWKN, see our HWKN price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $44.00 | Average Broker Recommendation | 1.5 (Moderate Buy) |

Hawkins, Inc. (HWKN) Company Bio

Hawkins, Inc. blends, manufactures, and distributes various chemical products. The company operates in two segments, Industrial and Water Treatment. The company was founded in 1938 and is based in Roseville, Minnesota.

Latest HWKN News From Around the Web

Below are the latest news stories about HAWKINS INC that investors may wish to consider to help them evaluate HWKN as an investment opportunity.

Hawkins (HWKN) Up 51% in 6 Months: What's Driving the Stock?Hawkins (HWKN) benefits from the robust Water Treatment segment, strategic acquisitions and a prudent pricing strategy. |

Energy Fuels (UUUU), Astorn Sign MOU to Develop Donald ProjectEnergy Fuels (UUUU) inks MOU with Astorn to co-develop the Donald Project in Australia. |

Energy Fuels (UUUU) Commences Production at Three Uranium MinesEnergy Fuels (UUUU) starts production at three of its uranium mines, influenced by the uranium price hike. |

Agnico Eagle (AEM) Inks Financing Agreement With Firefox GoldAgnico Eagle (AEM) and FireFox entered into an investor rights agreement in connection with the private placement. |

Why You Should Hold Onto Reliance Steel (RS) Stock for NowWhile Reliance Steel (RS) faces headwinds from pricing pressure, it benefits from strong demand in its major markets and acquisitions. |

HWKN Price Returns

| 1-mo | -7.79% |

| 3-mo | 1.83% |

| 6-mo | 13.22% |

| 1-year | 51.17% |

| 3-year | 111.83% |

| 5-year | 243.49% |

| YTD | -12.79% |

| 2023 | 84.66% |

| 2022 | -0.81% |

| 2021 | 52.75% |

| 2020 | 16.44% |

| 2019 | 14.35% |

HWKN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching HWKN

Want to see what other sources are saying about Hawkins Inc's financials and stock price? Try the links below:Hawkins Inc (HWKN) Stock Price | Nasdaq

Hawkins Inc (HWKN) Stock Quote, History and News - Yahoo Finance

Hawkins Inc (HWKN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...