AstroNova, Inc. (ALOT): Price and Financial Metrics

ALOT Price/Volume Stats

| Current price | $17.49 | 52-week high | $18.83 |

| Prev. close | $17.60 | 52-week low | $11.63 |

| Day low | $17.23 | Volume | 3,400 |

| Day high | $17.50 | Avg. volume | 13,370 |

| 50-day MA | $16.44 | Dividend yield | N/A |

| 200-day MA | $14.66 | Market Cap | 130.00M |

ALOT Stock Price Chart Interactive Chart >

ALOT POWR Grades

- Growth is the dimension where ALOT ranks best; there it ranks ahead of 94.19% of US stocks.

- ALOT's strongest trending metric is Growth; it's been moving down over the last 167 days.

- ALOT ranks lowest in Momentum; there it ranks in the 29th percentile.

ALOT Stock Summary

- ALOT's went public 38.03 years ago, making it older than 92.92% of listed US stocks we're tracking.

- With a year-over-year growth in debt of -19.68%, ASTRONOVA INC's debt growth rate surpasses merely 16.56% of about US stocks.

- In terms of twelve month growth in earnings before interest and taxes, ASTRONOVA INC is reporting a growth rate of 203.71%; that's higher than 94.17% of US stocks.

- If you're looking for stocks that are quantitatively similar to ASTRONOVA INC, a group of peers worth examining would be CSPI, ATRI, IART, INTT, and CW.

- Visit ALOT's SEC page to see the company's official filings. To visit the company's web site, go to www.astronovainc.com.

ALOT Valuation Summary

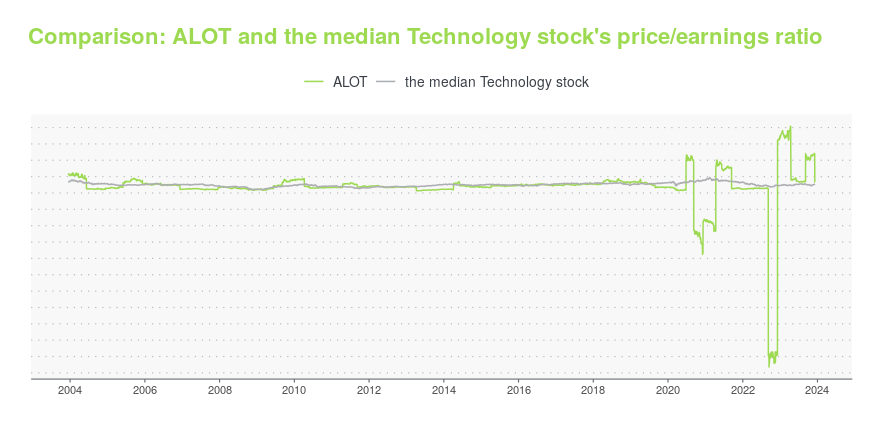

- ALOT's price/earnings ratio is 33.3; this is 24.95% higher than that of the median Technology stock.

- ALOT's EV/EBIT ratio has moved down 2.6 over the prior 243 months.

Below are key valuation metrics over time for ALOT.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| ALOT | 2023-12-08 | 0.8 | 1.3 | 33.3 | 19.4 |

| ALOT | 2023-12-07 | 0.7 | 1.3 | 33.2 | 19.3 |

| ALOT | 2023-12-06 | 0.8 | 1.3 | 33.7 | 19.5 |

| ALOT | 2023-12-05 | 0.7 | 1.2 | 117.7 | 34.2 |

| ALOT | 2023-12-04 | 0.7 | 1.3 | 120.7 | 34.9 |

| ALOT | 2023-12-01 | 0.7 | 1.3 | 121.1 | 35.0 |

ALOT Growth Metrics

- Its 4 year net cashflow from operations growth rate is now at 73.1%.

- The 3 year net cashflow from operations growth rate now stands at -163.72%.

- The 2 year price growth rate now stands at 97.23%.

The table below shows ALOT's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 132.374 | -9.909 | 0.54 |

| 2022-06-30 | 121.826 | -7.918 | -0.174 |

| 2022-03-31 | 119.412 | -4.129 | 6.261 |

| 2021-12-31 | 117.48 | 1.394 | 6.429 |

| 2021-09-30 | 117.218 | 7.725 | 8.024 |

| 2021-06-30 | 116.378 | 11.873 | 8.461 |

ALOT Price Target

For more insight on analysts targets of ALOT, see our ALOT price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $26.00 | Average Broker Recommendation | 2 (Hold) |

AstroNova, Inc. (ALOT) Company Bio

Astro-Med, Inc., doing business as AstroNova, designs, develops, manufactures, and distributes various specialty printers, and data acquisition and analysis systems in the United States. The company was founded in 1969 and is based in West Warwick, Rhode Island.

Latest ALOT News From Around the Web

Below are the latest news stories about ASTRONOVA INC that investors may wish to consider to help them evaluate ALOT as an investment opportunity.

Can Mixed Fundamentals Have A Negative Impact on AstroNova, Inc. (NASDAQ:ALOT) Current Share Price Momentum?AstroNova's (NASDAQ:ALOT) stock is up by a considerable 32% over the past three months. But the company's key financial... |

AstroNova, Inc. (NASDAQ:ALOT) Q3 2024 Earnings Call TranscriptAstroNova, Inc. (NASDAQ:ALOT) Q3 2024 Earnings Call Transcript December 6, 2023 Operator: Good morning, and welcome to the AstroNova Fiscal Third Quarter 2024 Financial Results Conference Call. Today’s conference is being recorded. [Operator Instructions]. I would now like to turn the conference over to Scott Solomon of the company’s Investor Relations firm, Sharon Merrill Advisors. […] |

Q3 2024 AstroNova Inc Earnings CallQ3 2024 AstroNova Inc Earnings Call |

AstroNova Inc (ALOT) Reports Mixed Fiscal 2024 Q3 Results with Strong Profit Growth Despite ...Revenue Declines by 4.7% YoY; Gross Margin and Operating Margin See Significant Increases |

AstroNova Reports Fiscal 2024 Third-Quarter Financial ResultsWEST WARWICK, R.I., December 06, 2023--AstroNova, Inc. (Nasdaq: ALOT), a global leader in data visualization technologies, today reported financial results for the fiscal 2024 third quarter ended October 28, 2023. GAAP diluted earnings per share were $0.37 compared with $0.04 per diluted share in the year-earlier period. Last year’s third-quarter GAAP results included transaction costs of $0.07 per diluted share associated with the acquisition of Astro Machine, Inc. at the beginning of that quar |

ALOT Price Returns

| 1-mo | 1.80% |

| 3-mo | 25.83% |

| 6-mo | 20.37% |

| 1-year | 37.18% |

| 3-year | 53.15% |

| 5-year | -10.49% |

| YTD | 7.56% |

| 2023 | 26.83% |

| 2022 | -5.04% |

| 2021 | 26.76% |

| 2020 | -21.66% |

| 2019 | -25.67% |

Continue Researching ALOT

Want to do more research on AstroNova Inc's stock and its price? Try the links below:AstroNova Inc (ALOT) Stock Price | Nasdaq

AstroNova Inc (ALOT) Stock Quote, History and News - Yahoo Finance

AstroNova Inc (ALOT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...