eGain Corporation (EGAN): Price and Financial Metrics

EGAN Price/Volume Stats

| Current price | $7.63 | 52-week high | $10.35 |

| Prev. close | $7.64 | 52-week low | $5.61 |

| Day low | $7.52 | Volume | 48,100 |

| Day high | $7.70 | Avg. volume | 57,633 |

| 50-day MA | $7.86 | Dividend yield | N/A |

| 200-day MA | $7.08 | Market Cap | 240.23M |

EGAN Stock Price Chart Interactive Chart >

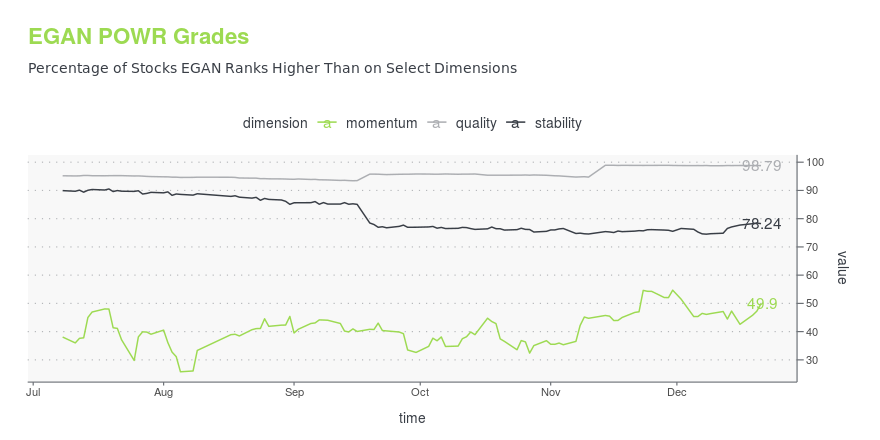

EGAN POWR Grades

- EGAN scores best on the Quality dimension, with a Quality rank ahead of 98.79% of US stocks.

- The strongest trend for EGAN is in Stability, which has been heading down over the past 166 days.

- EGAN's current lowest rank is in the Momentum metric (where it is better than 49.9% of US stocks).

EGAN Stock Summary

- The ratio of debt to operating expenses for EGAIN CORP is higher than it is for about just 8.24% of US stocks.

- With a year-over-year growth in debt of -29.93%, EGAIN CORP's debt growth rate surpasses merely 10.75% of about US stocks.

- In terms of twelve month growth in earnings before interest and taxes, EGAIN CORP is reporting a growth rate of -498.18%; that's higher than merely 2.53% of US stocks.

- If you're looking for stocks that are quantitatively similar to EGAIN CORP, a group of peers worth examining would be DAIO, VICR, LQDT, JNPR, and ACLS.

- EGAN's SEC filings can be seen here. And to visit EGAIN CORP's official web site, go to www.egain.com.

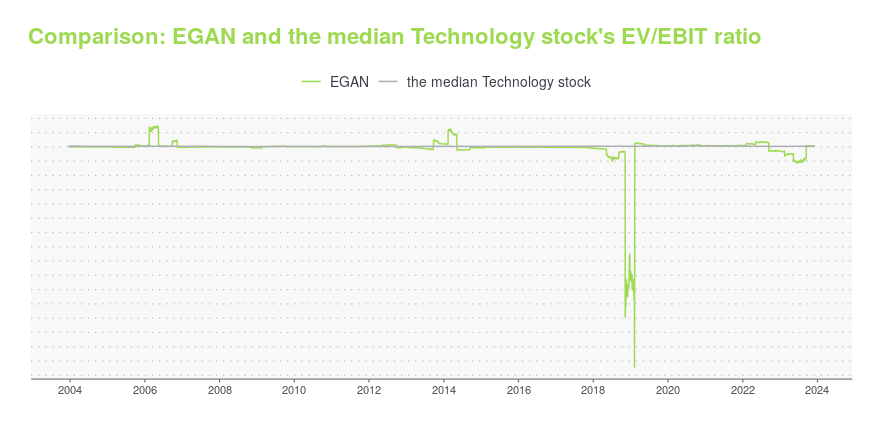

EGAN Valuation Summary

- EGAN's EV/EBIT ratio is 29.5; this is 39.15% higher than that of the median Technology stock.

- EGAN's price/earnings ratio has moved up 53.9 over the prior 243 months.

Below are key valuation metrics over time for EGAN.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| EGAN | 2023-12-08 | 2.6 | 3.9 | 53.3 | 29.5 |

| EGAN | 2023-12-07 | 2.5 | 3.9 | 52.6 | 28.9 |

| EGAN | 2023-12-06 | 2.5 | 3.8 | 52.1 | 28.5 |

| EGAN | 2023-12-05 | 2.6 | 4.0 | 54.5 | 30.4 |

| EGAN | 2023-12-04 | 2.6 | 3.9 | 53.4 | 29.5 |

| EGAN | 2023-12-01 | 2.4 | 3.7 | 50.2 | 27.0 |

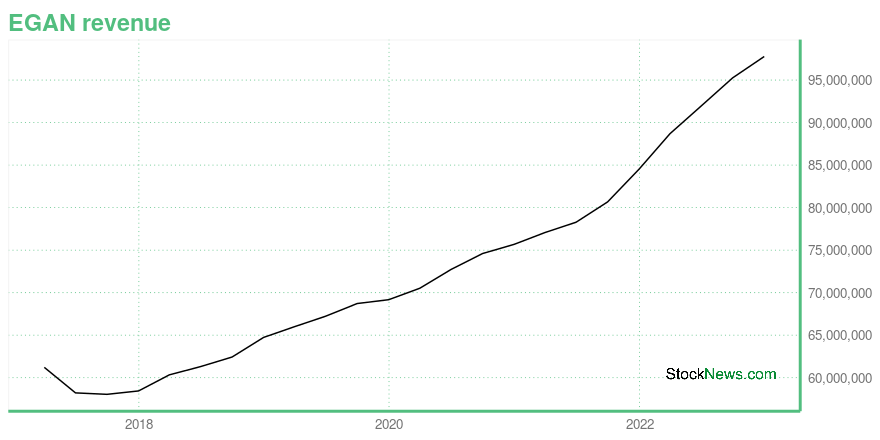

EGAN Growth Metrics

- Its 3 year price growth rate is now at 13.07%.

- The 3 year net income to common stockholders growth rate now stands at -66.59%.

- Its 2 year price growth rate is now at -2.57%.

The table below shows EGAN's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 97.771 | 11.615 | -2.286 |

| 2022-09-30 | 95.264 | 1.711 | -3.008 |

| 2022-06-30 | 91.951 | 8.121 | -2.441 |

| 2022-03-31 | 88.696 | 14.702 | 1.158 |

| 2021-12-31 | 84.535 | 12.596 | 3.034 |

| 2021-09-30 | 80.675 | 15.298 | 5.466 |

EGAN's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- EGAN has a Quality Grade of A, ranking ahead of 98.48% of graded US stocks.

- EGAN's asset turnover comes in at 0.795 -- ranking 182nd of 563 Business Services stocks.

- QMCI, TGH, and FPAY are the stocks whose asset turnover ratios are most correlated with EGAN.

The table below shows EGAN's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.795 | 0.754 | -0.300 |

| 2021-03-31 | 0.826 | 0.751 | -0.382 |

| 2020-12-31 | 0.846 | 0.738 | -0.441 |

| 2020-09-30 | 0.871 | 0.727 | -0.488 |

| 2020-06-30 | 0.882 | 0.710 | -0.522 |

| 2020-03-31 | 0.910 | 0.690 | -0.407 |

EGAN Price Target

For more insight on analysts targets of EGAN, see our EGAN price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $17.00 | Average Broker Recommendation | 1.67 (Moderate Buy) |

eGain Corporation (EGAN) Company Bio

eGain Corporation provides cloud-based customer engagement software solutions worldwide. The company offers eGain software suite, including eGain Mobile for businesses to offer engagement options in the eGain suite to mobile users. The company was founded in 1997 and is based in Sunnyvale, California.

Latest EGAN News From Around the Web

Below are the latest news stories about EGAIN CORP that investors may wish to consider to help them evaluate EGAN as an investment opportunity.

Why eGain (EGAN) Outpaced the Stock Market TodayThe latest trading day saw eGain (EGAN) settling at $8.31, representing a +0.48% change from its previous close. |

TENAQUIP Selects eGain for Digital Customer ServiceSUNNYVALE, Calif., Dec. 12, 2023 (GLOBE NEWSWIRE) -- eGain Corporation (NASDAQ: EGAN), the knowledge automation platform for customer engagement, announced that TENAQUIP Limited, a leading distributor of industrial supplies, selected eGain for digital customer service (DCS). One of Canada’s Best Managed Companies, TENAQUIP is committed to providing exceptional customer service, appropriately named “Signature Service,” to match the high quality of products they distribute. The company sells and d |

Investment Management Giant Selects eGain to Modernize Knowledge ManagementSUNNYVALE, Calif., Dec. 05, 2023 (GLOBE NEWSWIRE) -- eGain Corporation (NASDAQ: EGAN), the knowledge automation platform for customer engagement, announced that a global investment management company has selected eGain Knowledge Hub™ to transform experiences for thousands of contact center agents, financial advisors, and knowledge authors. Investment management CX has been stuck on a plateau six years in a row, according to the Forrester CX Index. Saddled with a legacy system, the company’s inve |

David Kanen, president of Kwm llc issues letter to the eGain board calling for the formation of a special committee and sale of egan. He also excoriates CEO Ashu Roy.CORAL SPRINGS, Fla., Dec. 04, 2023 (GLOBE NEWSWIRE) -- Dear EGAN Board of Directors, We, Kanen Wealth Management, LLC, owner of approximately 7% of eGain Corporation’s (“EGAN” or the “Company”) common shares, are calling on the board to formally hire an investment banker and form a special committee to pursue a sale of the Company. Under CEO Ashu Roy’s leadership, EGAN’s stock is down approximately 40% since the Company’s IPO 24 years ago in 1999 versus the NASDAQ gain of approximately 500%. The |

Time to Buy These Affordable Tech Stocks for More UpsideSporting a Zacks Rank #1 (Strong Buy) now looks like an ideal time to invest in these affordable and promising tech stocks for more upside. |

EGAN Price Returns

| 1-mo | -2.55% |

| 3-mo | 16.13% |

| 6-mo | 5.39% |

| 1-year | -23.93% |

| 3-year | -35.56% |

| 5-year | -30.57% |

| YTD | -8.40% |

| 2023 | -7.75% |

| 2022 | -9.52% |

| 2021 | -15.50% |

| 2020 | 49.12% |

| 2019 | 20.55% |

Continue Researching EGAN

Want to see what other sources are saying about EGAIN Corp's financials and stock price? Try the links below:EGAIN Corp (EGAN) Stock Price | Nasdaq

EGAIN Corp (EGAN) Stock Quote, History and News - Yahoo Finance

EGAIN Corp (EGAN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...