BeiGene Ltd. ADR (BGNE): Price and Financial Metrics

BGNE Price/Volume Stats

| Current price | $142.88 | 52-week high | $272.49 |

| Prev. close | $147.76 | 52-week low | $132.95 |

| Day low | $141.54 | Volume | 237,900 |

| Day high | $145.89 | Avg. volume | 343,263 |

| 50-day MA | $171.20 | Dividend yield | N/A |

| 200-day MA | $194.11 | Market Cap | 13.62B |

BGNE Stock Price Chart Interactive Chart >

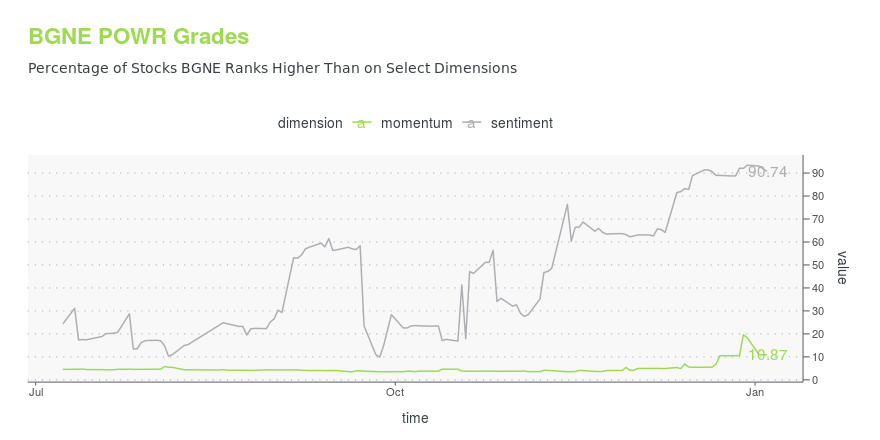

BGNE POWR Grades

- Sentiment is the dimension where BGNE ranks best; there it ranks ahead of 90.74% of US stocks.

- The strongest trend for BGNE is in Sentiment, which has been heading up over the past 26 weeks.

- BGNE's current lowest rank is in the Momentum metric (where it is better than 10.87% of US stocks).

BGNE Stock Summary

- With a market capitalization of $18,992,331,352, BEIGENE LTD has a greater market value than 88.73% of US stocks.

- BGNE's price/sales ratio is 8.62; that's higher than the P/S ratio of 87.57% of US stocks.

- As for revenue growth, note that BGNE's revenue has grown 76.39% over the past 12 months; that beats the revenue growth of 94.09% of US companies in our set.

- If you're looking for stocks that are quantitatively similar to BEIGENE LTD, a group of peers worth examining would be LCID, RYTM, TDUP, SAGE, and LUMO.

- Visit BGNE's SEC page to see the company's official filings. To visit the company's web site, go to www.beigene.com.

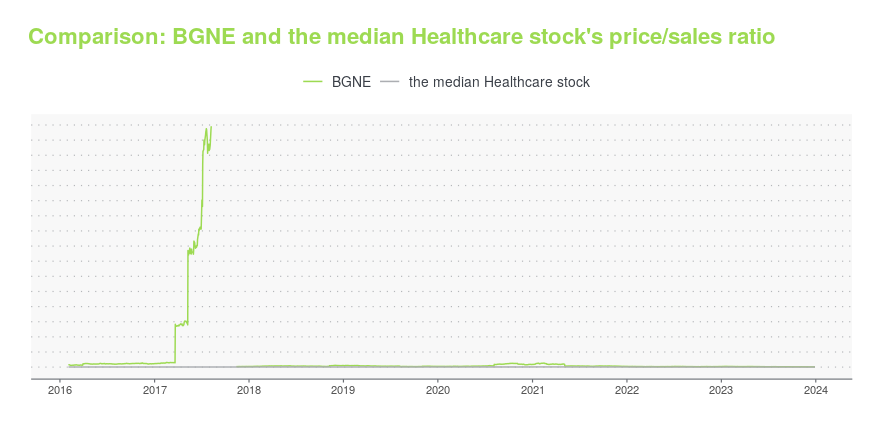

BGNE Valuation Summary

- BGNE's price/sales ratio is 8.6; this is 290.91% higher than that of the median Healthcare stock.

- Over the past 96 months, BGNE's EV/EBIT ratio has gone up 41.8.

Below are key valuation metrics over time for BGNE.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| BGNE | 2023-12-29 | 8.6 | 5.0 | -19.7 | -16.7 |

| BGNE | 2023-12-28 | 8.5 | 5.0 | -19.6 | -16.6 |

| BGNE | 2023-12-27 | 8.5 | 5.0 | -19.5 | -16.5 |

| BGNE | 2023-12-26 | 8.3 | 4.9 | -19.1 | -16.2 |

| BGNE | 2023-12-22 | 8.4 | 4.9 | -19.2 | -16.2 |

| BGNE | 2023-12-21 | 8.4 | 4.9 | -19.3 | -16.3 |

BGNE Growth Metrics

- Its 4 year price growth rate is now at 330.2%.

- Its 3 year net income to common stockholders growth rate is now at -159.78%.

- The year over year cash and equivalents growth rate now stands at 128.56%.

The table below shows BGNE's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 1,249.805 | -1,686.267 | -2,148.932 |

| 2022-06-30 | 1,068.617 | -1,620.074 | -2,005.231 |

| 2022-03-31 | 877.037 | -1,660.381 | -1,914.123 |

| 2021-12-31 | 1,176.283 | -1,298.723 | -1,413.354 |

| 2021-09-30 | 1,062.404 | -1,123.218 | -1,300.446 |

| 2021-06-30 | 947.044 | -973.746 | -1,311.815 |

BGNE's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- BGNE has a Quality Grade of C, ranking ahead of 25.08% of graded US stocks.

- BGNE's asset turnover comes in at 0.168 -- ranking 211th of 681 Pharmaceutical Products stocks.

- AADI, CPIX, and NAVB are the stocks whose asset turnover ratios are most correlated with BGNE.

The table below shows BGNE's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.168 | 0.883 | -0.377 |

| 2021-03-31 | 0.165 | 0.897 | -0.358 |

| 2020-12-31 | 0.065 | 0.771 | -0.552 |

| 2020-09-30 | 0.070 | 0.746 | -0.678 |

| 2020-06-30 | 0.078 | 0.704 | -0.890 |

| 2020-03-31 | 0.166 | 0.826 | -0.893 |

BeiGene Ltd. ADR (BGNE) Company Bio

BeiGene is a biotechnology company that specializes in the development of drugs for cancer treatment. Founded in Beijing in 2010 by Xiaodong Wang and chief executive officer John V. Oyler, the company has offices in China, the United States, Australia and Europe. BeiGene has developed several pharmaceuticals, including tislelizumab, a checkpoint inhibitor, and zanubrutinib, a Bruton's tyrosine kinase inhibitor which became the first cancer drug developed in China to gain approval from the U.S. Food and Drug Administration when it received accelerated approval to treat mantle cell lymphoma in November 2019. (Source:Wikipedia)

Latest BGNE News From Around the Web

Below are the latest news stories about BEIGENE LTD that investors may wish to consider to help them evaluate BGNE as an investment opportunity.

12 High Growth International Stocks to BuyIn this article, we discuss the 12 high growth international stocks to buy. If you want to read about some more high growth international stocks, go directly to 5 High Growth International Stocks to Buy. There is general optimism on Wall Street that the Federal Reserve in the United States will be able to achieve […] |

FDA Approves Label Update for BRUKINSA® (zanubrutinib) in Chronic Lymphocytic Leukemia (CLL)BASEL, Switzerland & BEIJING & CAMBRIDGE, Mass., December 22, 2023--BeiGene, Ltd. (NASDAQ: BGNE; HKEX: 06160; SSE: 688235), a global biotechnology company, today announced the U.S. Food and Drug Administration (FDA) has approved a label update for BRUKINSA® (zanubrutinib) to include superior progression-free survival (PFS) results from the Phase 3 ALPINE trial comparing BRUKINSA against IMBRUVICA® (ibrutinib) in previously treated patients with relapsed or refractory (R/R) chronic lymphocytic le |

3 Cancer-Focused Biotechs That Appear Promising Bets for 2024With the spotlight on oncology-focused companies in the biotech sector in 2023, we discuss three stocks that have a promising oncology portfolio/pipeline for 2024. |

BeiGene to Present at the 42nd Annual J.P. Morgan Healthcare ConferenceBASEL, Switzerland & BEIJING & CAMBRIDGE, Mass., December 21, 2023--BeiGene, Ltd. (NASDAQ: BGNE; HKEX: 06160; SSE: 688235), a global biotechnology company, today announced that the Company will participate in the 42nd Annual J.P. Morgan Healthcare Conference on Monday, January 8th, 2024 with a presentation at 1:30 pm PT. |

13 Most Promising Healthcare Stocks According to AnalystsIn this article, we discuss the 13 most promising healthcare stocks according to analysts. To skip the detailed overview of the healthcare sector, go directly to the 5 Most Promising Healthcare Stocks According to Analysts. The healthcare industry landscape is changing. While the COVID-19 pandemic was one of the most significant events that led to […] |

BGNE Price Returns

| 1-mo | -21.27% |

| 3-mo | -28.24% |

| 6-mo | -27.72% |

| 1-year | -42.84% |

| 3-year | -61.28% |

| 5-year | 10.54% |

| YTD | -20.78% |

| 2023 | -18.00% |

| 2022 | -18.82% |

| 2021 | 4.85% |

| 2020 | 55.88% |

| 2019 | 18.18% |

Continue Researching BGNE

Want to see what other sources are saying about BeiGene Ltd's financials and stock price? Try the links below:BeiGene Ltd (BGNE) Stock Price | Nasdaq

BeiGene Ltd (BGNE) Stock Quote, History and News - Yahoo Finance

BeiGene Ltd (BGNE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...