First Citizens BancShares, Inc. - (FCNCA): Price and Financial Metrics

FCNCA Price/Volume Stats

| Current price | $1,478.12 | 52-week high | $1,552.00 |

| Prev. close | $1,484.03 | 52-week low | $505.84 |

| Day low | $1,466.46 | Volume | 39,300 |

| Day high | $1,485.20 | Avg. volume | 89,704 |

| 50-day MA | $1,440.09 | Dividend yield | 0.43% |

| 200-day MA | $1,353.36 | Market Cap | 21.46B |

FCNCA Stock Price Chart Interactive Chart >

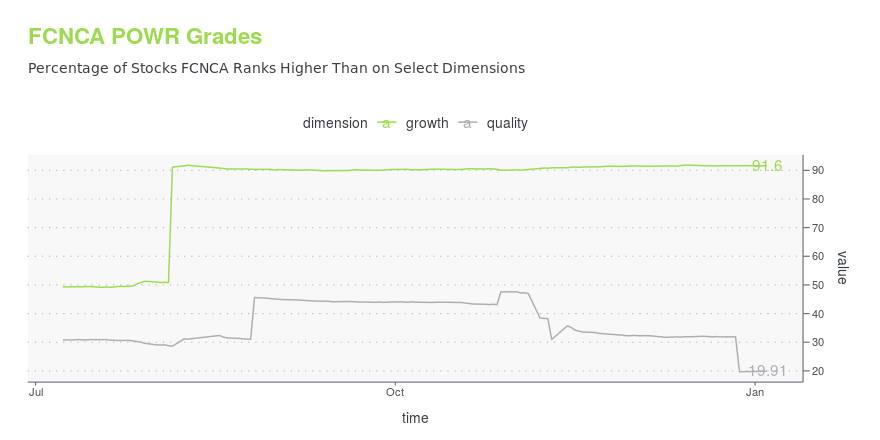

FCNCA POWR Grades

- Growth is the dimension where FCNCA ranks best; there it ranks ahead of 91.6% of US stocks.

- FCNCA's strongest trending metric is Growth; it's been moving up over the last 26 weeks.

- FCNCA ranks lowest in Quality; there it ranks in the 19th percentile.

FCNCA Stock Summary

- With a price/earnings ratio of 1.82, FIRST CITIZENS BANCSHARES INC P/E ratio is greater than that of about only 0.97% of stocks in our set with positive earnings.

- In terms of twelve month growth in earnings before interest and taxes, FIRST CITIZENS BANCSHARES INC is reporting a growth rate of 946.27%; that's higher than 98.91% of US stocks.

- As for revenue growth, note that FCNCA's revenue has grown 334.87% over the past 12 months; that beats the revenue growth of 98.34% of US companies in our set.

- If you're looking for stocks that are quantitatively similar to FIRST CITIZENS BANCSHARES INC, a group of peers worth examining would be TCBK, LCNB, PEBO, RF, and CMA.

- FCNCA's SEC filings can be seen here. And to visit FIRST CITIZENS BANCSHARES INC's official web site, go to www.firstcitizens.com.

FCNCA Valuation Summary

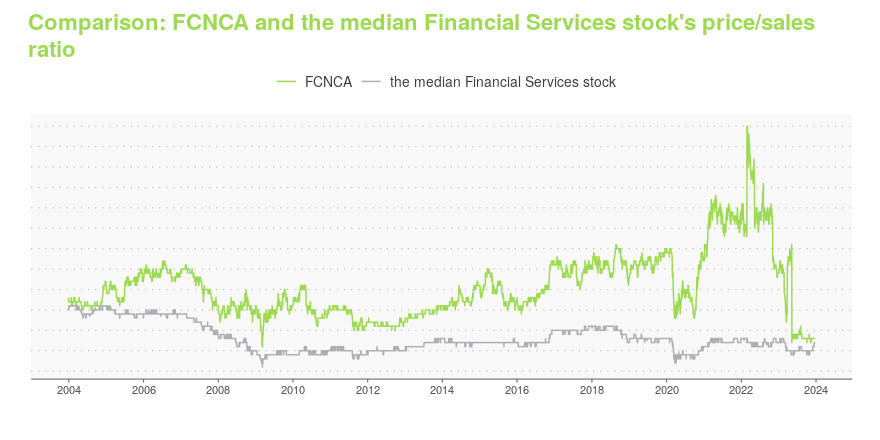

- FCNCA's price/sales ratio is 1.3; this is 8.33% higher than that of the median Financial Services stock.

- FCNCA's price/sales ratio has moved down 1 over the prior 243 months.

Below are key valuation metrics over time for FCNCA.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| FCNCA | 2023-12-22 | 1.3 | 1 | 1.9 | 1.9 |

| FCNCA | 2023-12-21 | 1.3 | 1 | 1.8 | 1.9 |

| FCNCA | 2023-12-20 | 1.3 | 1 | 1.8 | 1.9 |

| FCNCA | 2023-12-19 | 1.3 | 1 | 1.9 | 1.9 |

| FCNCA | 2023-12-18 | 1.3 | 1 | 1.9 | 1.9 |

| FCNCA | 2023-12-15 | 1.3 | 1 | 1.9 | 1.9 |

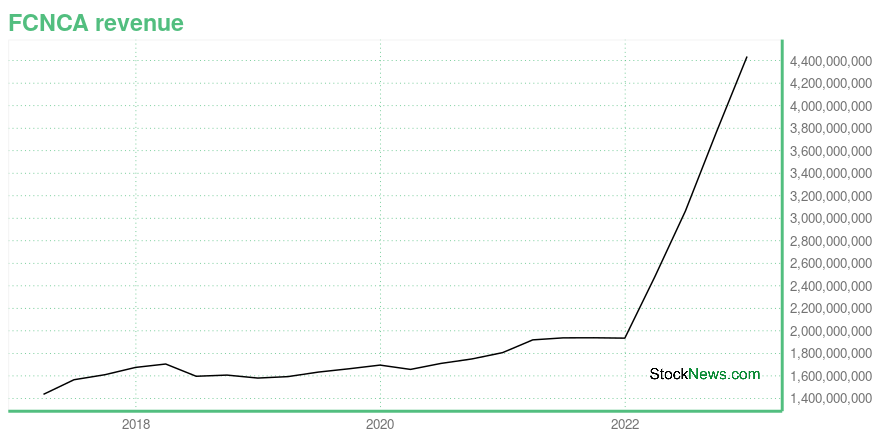

FCNCA Growth Metrics

- The 3 year net cashflow from operations growth rate now stands at -97.47%.

- Its 3 year revenue growth rate is now at 55.82%.

- Its 5 year cash and equivalents growth rate is now at -64.72%.

The table below shows FCNCA's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 4,437 | 2,791 | 1,048 |

| 2022-09-30 | 3,761.799 | 1,948.988 | 923.646 |

| 2022-06-30 | 3,064.75 | 1,557.272 | 740.083 |

| 2022-03-31 | 2,482.896 | 11.341 | 650.235 |

| 2021-12-31 | 1,935.171 | -283.783 | 528.915 |

| 2021-09-30 | 1,938.45 | -338.014 | 543.717 |

FCNCA's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- FCNCA has a Quality Grade of C, ranking ahead of 25.44% of graded US stocks.

- FCNCA's asset turnover comes in at 0.037 -- ranking 237th of 431 Banking stocks.

- OCN, BCOR, and BUSE are the stocks whose asset turnover ratios are most correlated with FCNCA.

The table below shows FCNCA's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.037 | 1 | 0.016 |

| 2021-03-31 | 0.038 | 1 | 0.016 |

| 2020-12-31 | 0.038 | 1 | 0.014 |

| 2020-09-30 | 0.039 | 1 | 0.013 |

| 2020-06-30 | 0.041 | 1 | 0.014 |

| 2020-03-31 | 0.042 | 1 | 0.013 |

FCNCA Price Target

For more insight on analysts targets of FCNCA, see our FCNCA price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $1,031.67 | Average Broker Recommendation | 1.33 (Strong Buy) |

First Citizens BancShares, Inc. - (FCNCA) Company Bio

First Citizens Bancshares is the financial holding company for First Citizens Bank. First Citizens Bank provides a broad range of financial services to individuals, businesses, professionals and the medical community through branch offices in 18 states and the District of Columbia, online banking, mobile banking, ATMs and telephone banking. The company was founded in 1898 and is based in Raleigh, North Carolina.

Latest FCNCA News From Around the Web

Below are the latest news stories about FIRST CITIZENS BANCSHARES INC that investors may wish to consider to help them evaluate FCNCA as an investment opportunity.

2 Bank Stocks Wall Street Analysts Recommend Buying for 2024Analyst-recommended bank stocks - First Citizens BancShares (FCNCA) and Wintrust Financial (WTFC) - can be considered for 2024 on solid prospects despite near-term headwinds. |

How to Boost Your Portfolio with Top Finance Stocks Set to Beat EarningsWhy investors should use the Zacks Earnings ESP tool to help find stocks that are poised to top quarterly earnings estimates. |

CIT Northbridge Credit Provides Working Capital Financing to Winona FoodsFirst Citizens Bank today announced that CIT Northbridge Credit, as advised by First Citizens Institutional Asset Management LLC, has provided working capital financing via a revolving line of credit to Winona Foods in Green Bay, Wisconsin. |

First Citizens Bank Provides $65.2 Million to Jupiter Power for Standalone Battery Energy Storage Project FinancingFirst Citizens Bank and Jupiter Power LLC ("Jupiter Power") today announced that First Citizens Bank's Energy Finance business and Jupiter Power have closed on $65.2 million in financing for construction of a 200-megawatt (MW) / 400 megawatt-hour (MWh) battery energy storage system in Houston, Texas. |

12 Most Profitable Cheap Stocks To BuyIn this piece, we will take a look at the 12 most profitable cheap stocks to buy. If you want to skip our coverage of the latest happenings in the renewable energy industry, then you can skip ahead to 5 Most Profitable Cheap Stocks To Buy. As investors seek to exit 2023 with the hopes […] |

FCNCA Price Returns

| 1-mo | 6.30% |

| 3-mo | 5.29% |

| 6-mo | 0.75% |

| 1-year | 89.45% |

| 3-year | 116.88% |

| 5-year | 263.74% |

| YTD | 4.17% |

| 2023 | 87.73% |

| 2022 | -8.35% |

| 2021 | 44.83% |

| 2020 | 8.35% |

| 2019 | 41.64% |

FCNCA Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching FCNCA

Here are a few links from around the web to help you further your research on First Citizens Bancshares Inc's stock as an investment opportunity:First Citizens Bancshares Inc (FCNCA) Stock Price | Nasdaq

First Citizens Bancshares Inc (FCNCA) Stock Quote, History and News - Yahoo Finance

First Citizens Bancshares Inc (FCNCA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...