Precipio, Inc. (PRPO): Price and Financial Metrics

PRPO Price/Volume Stats

| Current price | $6.48 | 52-week high | $19.80 |

| Prev. close | $6.91 | 52-week low | $4.75 |

| Day low | $5.91 | Volume | 31,100 |

| Day high | $6.77 | Avg. volume | 10,896 |

| 50-day MA | $6.40 | Dividend yield | N/A |

| 200-day MA | $7.78 | Market Cap | 9.20M |

PRPO Stock Price Chart Interactive Chart >

PRPO Stock Summary

- PRPO has a market capitalization of $8,973,770 -- more than approximately just 4.72% of US stocks.

- Revenue growth over the past 12 months for PRECIPIO INC comes in at 40.22%, a number that bests 88.58% of the US stocks we're tracking.

- In terms of volatility of its share price, PRPO is more volatile than 98.71% of stocks we're observing.

- Stocks that are quantitatively similar to PRPO, based on their financial statements, market capitalization, and price volatility, are WIRE, GIFI, CMT, CMC, and BIRD.

- Visit PRPO's SEC page to see the company's official filings. To visit the company's web site, go to www.precipiodx.com.

PRPO Valuation Summary

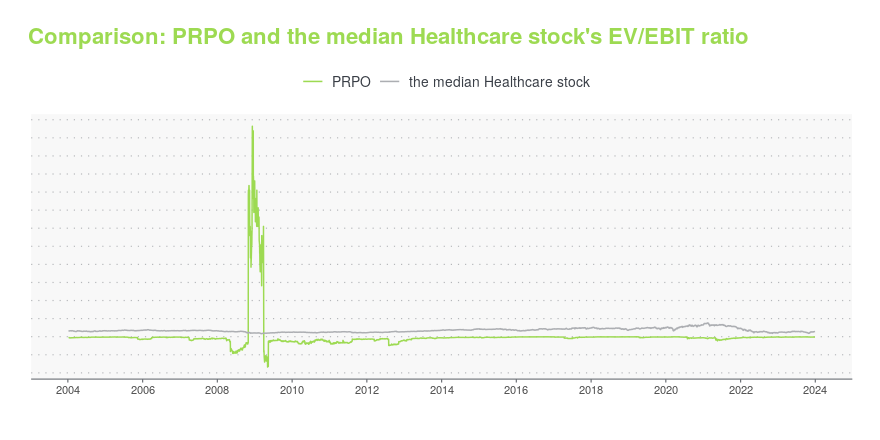

- PRPO's EV/EBIT ratio is -1; this is 106.85% lower than that of the median Healthcare stock.

- Over the past 243 months, PRPO's EV/EBIT ratio has gone up 1.3.

Below are key valuation metrics over time for PRPO.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| PRPO | 2023-12-29 | 0.7 | 0.7 | -1 | -1 |

| PRPO | 2023-12-28 | 0.7 | 0.7 | -1 | -1 |

| PRPO | 2023-12-27 | 0.7 | 0.7 | -1 | -1 |

| PRPO | 2023-12-26 | 0.7 | 0.7 | -1 | -1 |

| PRPO | 2023-12-22 | 0.7 | 0.7 | -1 | -1 |

| PRPO | 2023-12-21 | 0.7 | 0.7 | -1 | -1 |

PRPO Growth Metrics

- The 2 year net cashflow from operations growth rate now stands at 13.89%.

- Its 3 year revenue growth rate is now at 230.61%.

- Its 5 year net cashflow from operations growth rate is now at -428.1%.

The table below shows PRPO's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 9.456 | -7.621 | -12.118 |

| 2022-06-30 | 9.487 | -7.509 | -10.799 |

| 2022-03-31 | 9.472 | -7.622 | -11.668 |

| 2021-12-31 | 8.849 | -6.577 | -8.53 |

| 2021-09-30 | 8.355 | -6.628 | -8.194 |

| 2021-06-30 | 7.736 | -6.92 | -9.636 |

PRPO's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- PRPO has a Quality Grade of D, ranking ahead of 7.61% of graded US stocks.

- PRPO's asset turnover comes in at 0.324 -- ranking 58th of 76 Measuring and Control Equipment stocks.

- ROP, AXDX, and TMO are the stocks whose asset turnover ratios are most correlated with PRPO.

The table below shows PRPO's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.324 | 0.268 | 19.897 |

| 2021-03-31 | 0.331 | 0.223 | 15.583 |

| 2020-12-31 | 0.307 | 0.189 | 14.223 |

| 2020-09-30 | 0.247 | 0.135 | 15.678 |

| 2020-06-30 | 0.200 | 0.076 | 11.555 |

| 2020-03-31 | 0.174 | 0.084 | 12.523 |

PRPO Price Target

For more insight on analysts targets of PRPO, see our PRPO price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $7.00 | Average Broker Recommendation | 1.5 (Moderate Buy) |

Precipio, Inc. (PRPO) Company Bio

Precipio, Inc. operates as a biotechnology company. The Company offers medicines for oncology, cardiology, neurology, and inherited diseases. Precipio also provides specialized clinical and research services to biopharmaceutical companies developing targeted therapies. Precipio serves customers in the United States.

Latest PRPO News From Around the Web

Below are the latest news stories about PRECIPIO INC that investors may wish to consider to help them evaluate PRPO as an investment opportunity.

Precipio Management Shares Thoughts on 2023, and Looks Ahead To 2024NEW HAVEN, Conn., Dec. 14, 2023 (GLOBE NEWSWIRE) -- Management of specialty cancer diagnostics company Precipio, Inc. (NASDAQ: PRPO) shares thoughts and reflections looking back at 2023, and forward to 2024. At the start of 2023, management set three goals, all focused on achieving cash flow breakeven going forward: Target #1: For the pathology division, reaching estimated annualized revenues of $14M, which was expected to enable the division to achieve cash flow breakeven based on its cost stru |

Precipio Announces Q3-2023 Shareholder Update CallConference Call to be held on November 20th, 2023 at 5:00 PM ESTNEW HAVEN, Conn., Nov. 16, 2023 (GLOBE NEWSWIRE) -- Specialty cancer diagnostics company Precipio, Inc. (NASDAQ: PRPO), will be hosting its Q3-2023 corporate update call on November 20th, 2023 at 5:00 PM ET. The call will include updates on all of the company’s current core businesses. The conference call may be accessed by calling 844-695-5519 (international callers dial 1-412-902-6760). All callers should ask for the Precipio Inc. |

When Will Precipio, Inc. (NASDAQ:PRPO) Breakeven?Precipio, Inc. ( NASDAQ:PRPO ) is possibly approaching a major achievement in its business, so we would like to shine... |

Precipio to Report $4.5M Q3-2023 Revenues, Double From Q3-202228% Revenue Increase Is Major Step Toward Company BreakevenNEW HAVEN, Conn., Oct. 18, 2023 (GLOBE NEWSWIRE) -- Specialty cancer diagnostics company Precipio, Inc. (NASDAQ: PRPO), announces that Q3-2023 (unaudited) revenues have increased 28% to $4.5M from $3.5M in Q2-2023, and have more than doubled from $2.2M from Q3-2022. The combination of ongoing revenue growth in both the pathology and products divisions, alongside efficiency and cost reduction initiatives has rapidly moved the company towa |

Precipio’s Q3 Cash Burn From Operations (unaudited) Declines 59% YoY, from $2.5M in Q3-2022 to approximately $1M in Q3-2023Company anticipates current cash levels sufficient to reach breakevenNEW HAVEN, Conn., Oct. 03, 2023 (GLOBE NEWSWIRE) -- Specialty cancer diagnostics company Precipio, Inc. (NASDAQ: PRPO), announces that the combination of revenue growth and cost cutting initiatives has reduced Cash Burn From Operations (CBFO) by 59% compared to the same quarter last year, from approximately $2.5M/quarter to $1M/quarter. Management has set a target of reaching financial independence with its current cash reserve |

PRPO Price Returns

| 1-mo | 12.32% |

| 3-mo | -20.85% |

| 6-mo | -10.00% |

| 1-year | -65.25% |

| 3-year | -90.12% |

| 5-year | -86.91% |

| YTD | -0.31% |

| 2023 | -41.06% |

| 2022 | -65.10% |

| 2021 | -23.67% |

| 2020 | 0.98% |

| 2019 | -8.89% |

Continue Researching PRPO

Want to see what other sources are saying about Precipio Inc's financials and stock price? Try the links below:Precipio Inc (PRPO) Stock Price | Nasdaq

Precipio Inc (PRPO) Stock Quote, History and News - Yahoo Finance

Precipio Inc (PRPO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...