Amazon.com, Inc. (AMZN): Price and Financial Metrics

AMZN Price/Volume Stats

| Current price | $169.84 | 52-week high | $172.50 |

| Prev. close | $170.53 | 52-week low | $88.12 |

| Day low | $168.88 | Volume | 42,316,400 |

| Day high | $171.43 | Avg. volume | 49,438,957 |

| 50-day MA | $153.46 | Dividend yield | N/A |

| 200-day MA | $135.25 | Market Cap | 1.76T |

AMZN Stock Price Chart Interactive Chart >

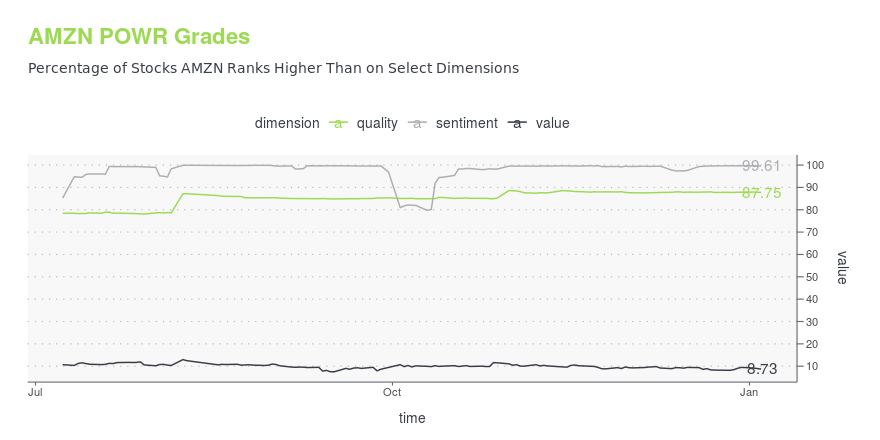

AMZN POWR Grades

- AMZN scores best on the Sentiment dimension, with a Sentiment rank ahead of 99.61% of US stocks.

- The strongest trend for AMZN is in Quality, which has been heading up over the past 26 weeks.

- AMZN's current lowest rank is in the Value metric (where it is better than 8.73% of US stocks).

AMZN Stock Summary

- AMZN has a market capitalization of $1,534,293,521,103 -- more than approximately 99.93% of US stocks.

- With a price/earnings ratio of 76.41, AMAZON COM INC P/E ratio is greater than that of about 91.81% of stocks in our set with positive earnings.

- In terms of twelve month growth in earnings before interest and taxes, AMAZON COM INC is reporting a growth rate of 115.48%; that's higher than 90.74% of US stocks.

- If you're looking for stocks that are quantitatively similar to AMAZON COM INC, a group of peers worth examining would be GOOGL, NVDA, META, TSLA, and LLY.

- AMZN's SEC filings can be seen here. And to visit AMAZON COM INC's official web site, go to www.amazon.com.

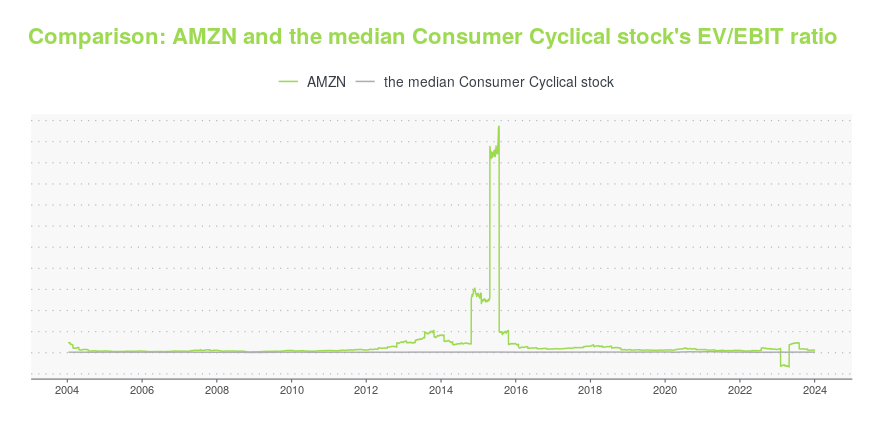

AMZN Valuation Summary

- AMZN's EV/EBIT ratio is 63.6; this is 315.69% higher than that of the median Consumer Cyclical stock.

- AMZN's price/earnings ratio has moved up 684.7 over the prior 243 months.

Below are key valuation metrics over time for AMZN.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| AMZN | 2023-12-29 | 2.8 | 8.6 | 78.2 | 63.6 |

| AMZN | 2023-12-28 | 2.9 | 8.7 | 78.9 | 64.1 |

| AMZN | 2023-12-27 | 2.9 | 8.7 | 78.9 | 64.1 |

| AMZN | 2023-12-26 | 2.9 | 8.7 | 79.0 | 64.2 |

| AMZN | 2023-12-22 | 2.9 | 8.7 | 79.0 | 64.2 |

| AMZN | 2023-12-21 | 2.9 | 8.7 | 79.2 | 64.3 |

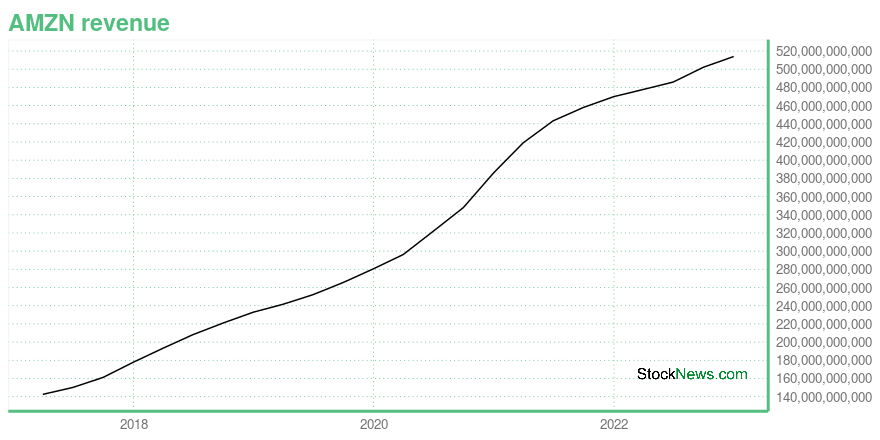

AMZN Growth Metrics

- The 2 year net income to common stockholders growth rate now stands at 102.74%.

- The year over year price growth rate now stands at -28.32%.

- The 4 year net cashflow from operations growth rate now stands at 133.54%.

The table below shows AMZN's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 513,983 | 46,752 | -2,722 |

| 2022-09-30 | 502,191 | 39,665 | 11,323 |

| 2022-06-30 | 485,902 | 35,574 | 11,607 |

| 2022-03-31 | 477,748 | 39,324 | 21,413 |

| 2021-12-31 | 469,822 | 46,327 | 33,364 |

| 2021-09-30 | 457,965 | 54,672 | 26,263 |

AMZN's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- AMZN has a Quality Grade of B, ranking ahead of 82.65% of graded US stocks.

- AMZN's asset turnover comes in at 1.321 -- ranking 98th of 165 Retail stocks.

- ELA, BIG, and KR are the stocks whose asset turnover ratios are most correlated with AMZN.

The table below shows AMZN's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 1.321 | 0.413 | 0.121 |

| 2021-06-30 | 1.378 | 0.407 | 0.145 |

| 2021-03-31 | 1.415 | 0.400 | 0.151 |

| 2020-12-31 | 1.426 | 0.396 | 0.131 |

| 2020-09-30 | 1.410 | 0.402 | 0.123 |

| 2020-06-30 | 1.424 | 0.403 | 0.110 |

AMZN Price Target

For more insight on analysts targets of AMZN, see our AMZN price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $4,157.35 | Average Broker Recommendation | 1.34 (Strong Buy) |

Amazon.com, Inc. (AMZN) Company Bio

Originally called “Cadabra,” Amazon.com, Inc’s website was launched on July 16th, 1995 by CEO and founder Jeff Bezos, selling only books online. Amazon provides a full suite of online retail shopping services. Moreover, the company has expanded beyond retail e-commerce to focus on four discrete customer sets: consumers, sellers, enterprises, and content creators. The company also provides other marketing and promotional services, such as online advertising and co-branded credit card agreements. In addition, Amazon manufactures and sells products such as, Kindle E-reader, Fire tablets, Fire TV, Amazon Echo, and Alexa. The company operates through three segments: North America, International, and Amazon Web Services (AWS). The North America segment consists of retail sales of consumer products and subscriptions through North America-focused websites such as www.amazon.com and www.amazon.ca. The International segment consists of retail sales of consumer products and subscriptions through internationally focused locations. AWS is the largest cloud computing platform, and the primary profit driver for Amazon. In 2020, AWS broke the record of being a $10 billion business. Amazon controls more than a third of the cloud market, almost twice its next closest competitor.

Latest AMZN News From Around the Web

Below are the latest news stories about AMAZON COM INC that investors may wish to consider to help them evaluate AMZN as an investment opportunity.

E-Commerce Evolution: 3 Retail Stocks Transforming Shopping in 2024After making heavy investments in their e-commerce operations, these retail stocks expect increased sales in 2024. |

Trading The Super Seven: RecapIn this article, we will review the performance of each of the Super Seven companies that may help you understand why they are “the talk of the town.” |

2024’s Power Players: 7 Stocks Racing to a Trillion ValuationWhether in 2024, or in the years ahead, each of these seven stocks could become the next trillion dollar companies. |

Legacy Investments: 7 Stocks to Make Your Grandkids MillionairesIf you believe in long-term investing like me, you will look for stocks that have a strong performance history and an ability to thrive in uncertain situations. |

AI and Automation Leaders for 2024: 7 Stocks to Stay Ahead of the Robot UprisingIt’s time for investors to ditch the search for the mythical crystal ball and instead embrace the algorithms when deciphering the best AI stock for your needs. |

AMZN Price Returns

| 1-mo | 12.20% |

| 3-mo | 18.31% |

| 6-mo | 22.71% |

| 1-year | 69.76% |

| 3-year | 2.22% |

| 5-year | 113.87% |

| YTD | 11.78% |

| 2023 | 80.88% |

| 2022 | -49.62% |

| 2021 | 2.38% |

| 2020 | 76.26% |

| 2019 | 23.03% |

Continue Researching AMZN

Want to do more research on Amazon Com Inc's stock and its price? Try the links below:Amazon Com Inc (AMZN) Stock Price | Nasdaq

Amazon Com Inc (AMZN) Stock Quote, History and News - Yahoo Finance

Amazon Com Inc (AMZN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...